September usually signals the beginning of our seasonal slowdown but that is certainly not the case when it comes to economic headlines. The job market is cooling at the same time inflation is creeping back up again, and all eyes are on the Fed’s upcoming meeting on the 16th–17th, with growing speculation about a potential rate cut. Meanwhile, a major bipartisan housing bill is gaining momentum in Congress, with proposals that could expand tax incentives and ramp up rental housing supply. In this month’s update, we unpack what all of this means for the rental market and how it’s shaping decisions across the industry.

Headlines

August Jobs Report - August’s jobs report delivered fresh warning signs for the U.S. labor market, with only 22,000 jobs added, well below forecasts and the unemployment rate rising to 4.3%, its highest since October 2021. Economists pointed to a broader hiring slowdown, as average monthly job growth has fallen to its lowest level since 2010 (excluding the pandemic). Mounting uncertainty from tariffs and the growing impact of AI adoption appear to be dampening demand, particularly for entry-level roles. Revisions to prior data also raised concerns, with June now showing a net loss of 13,000 jobs and July totals revised downward. The disappointing figures have strengthened expectations of a Federal Reserve rate cut this month, as signs of economic fatigue grow heading into the fall.

Weekly Jobless Claims - Jobless claims in the U.S. jumped by 27,000 to 263,000 in the week ending September 6, significantly above economists' forecasts. This surge aligns with broader signs of a weakening labor market, including the possibility that nonfarm payrolls were overstated by over 900,000 jobs in the past year. Recent data also shows job growth nearly stalling in August and declining in June, marking the first job losses in over four years. The Federal Reserve is widely expected to cut interest rates next week to respond to these softening trends and the ongoing tariff-related uncertainties. Meanwhile, the number of people continuing to collect benefits nationwide remains high at about 1.94 million. In Utah however, initial unemployment claims moved in a positive direction: 1,251 people filed new claims last week, down from 1,332 the prior week, suggesting less immediate distress locally.

Consumer Price Index - In August, U.S. consumer prices rose more than expected, with the CPI climbing 0.4% month-over-month, the highest since January bringing annual inflation to 2.9%. Core inflation, excluding food and energy, rose 0.3% for the month and 3.1% year-over-year, matching forecasts. At the same time, jobless claims unexpectedly surged to 263,000, the highest since October 2021, signaling a potential softening in the labor market. These developments come just before the Federal Reserve's key policy meeting on Sept. 17. Despite the slightly elevated inflation reading, markets are fully pricing in an interest rate cut, with the possibility of a larger 0.5% reduction due to the rise in unemployment claims. Market sentiment now points to multiple rate cuts in the coming months, reflecting concerns over economic slowdown and ongoing impacts from tariffs.

Fed Meeting - The Federal Reserve’s next policy meeting is scheduled for September 16–17, which falls just after the release of this publication; we’ll provide a full recap and analysis in the next update. In its most recent meeting, the Fed held interest rates steady at 4.25%–4.50%, with Chair Jerome Powell reaffirming a cautious, data-dependent approach despite political pressure and internal dissent. Looking ahead, market consensus has shifted firmly toward expectations of a rate cut in September, with the possibility of further easing later in the year should economic conditions warrant it.

A Federal Push to Renew the American Dream of Housing

In a rare moment of cooperation, Senators Tim Scott (R–SC) and Elizabeth Warren (D–MA) reached across the ideological divide to advance the Renewing Opportunity in the American Dream to Housing Act of 2025, also known as the ROAD to Housing Act. Unanimously passed by the Senate Banking Committee on July 29, the legislation represents the most significant housing initiative in more than a decade. It now moves to the full Senate for consideration.

Driving Forces and Momentum

The bipartisan frictionless collaboration surprised many, with both senators stressing a shared commitment: “we need more housing and less red tape”. Their unity reflects growing frustration across America—housing remains unaffordable for many, especially younger first-time buyers. Today, the average homebuyer’s age has climbed, and tight supply has caused median home prices to soar.

What’s in the ROAD Act?

This sweeping package consolidates over 40 housing-related measures, including:

Boosting Supply & Streamlining Development: Programs like the Build Now Act include a $1 billion Innovation Fund to reward communities that cut red tape and fast-track housing growth. Manufacturing and modular housing are encouraged through updated HUD definitions and financing guidelines.

Preservation & Repairs: The Whole-Home Repairs Act empowers low-income homeowners and small landlords with grants and forgivable loans, preserving housing stock and reducing deferred maintenance.

Affordable Ownership & Financing: The Act expands access to small-dollar mortgages, supports HUD’s Family Self-Sufficiency programs, and strengthens rental assistance tools such as RAD (Rental Assistance Demonstration).

Rural & Disaster Resilience: It includes permanent funding for HUD’s disaster recovery efforts and revitalizes rural housing programs.

Why Industry Groups Are Cheering

Leading housing and real estate organizations—including the NAR, NAHB, NAA, and Habitat for Humanity have widely endorsed the bill for its pragmatic solutions and inclusive scope.

What Property Owners Stand to Gain from the ROAD to Housing Act

While the ROAD to Housing Act is positioned as a broad affordability and supply solution, the legislation offers strategic advantages for existing rental property owners and investors particularly those navigating rising costs, regulatory complexity, and long-term sustainability concerns. Here's how:

1. Access to Repair Grants and Forgivable Loans

Small landlords (those owning 50 units or fewer) may qualify for Whole-Home Repair Program funds, which include grants and forgivable loans for needed maintenance and capital improvements.

This is especially impactful for older properties, where repairs are overdue but cost-prohibitive. These funds can improve habitability, extend asset life, and increase tenant satisfaction—without forcing a large upfront expense from the owner.

2. Lower Development and Upgrade Costs for ADUs and Infill

If you’re considering building an accessory dwelling unit (ADU), converting garages, or adding density on an underutilized lot, the bill offers a suite of incentives:

Pre-approved building designs (via the Accelerating Home Building Act)

Streamlined permitting and NEPA reform

HUD grants for infill and “missing middle” housing

Support for adaptive reuse of vacant buildings

For property owners with zoning flexibility or future development plans, these reforms could dramatically cut planning timelines and soft costs.

3. Easier Financing, Especially for Small-Dollar Loans

The legislation pushes federal housing agencies and lenders to expand small-dollar mortgage access and rehab loan availability—important for owners looking to buy, refinance, or upgrade lower-cost properties.

In parallel, the bill increases the public welfare investment cap for banks under the Community Reinvestment Act. This means more private capital flowing into affordable and workforce housing, expanding access to flexible debt and equity.

4. Support for Manufactured and Modular Properties

The bill tackles outdated HUD codes and GSE appraisal rules, making manufactured and modular housing easier to finance, insure, and integrate into rental portfolios.

For owners exploring build-to-rent or affordable single-family expansion, this opens the door to more scalable, cost-efficient construction methods without sacrificing quality or tenant livability.

5. Market Stabilization + Policy Clarity

By investing in housing supply, supporting rental preservation, and encouraging development near transit and job centers, the bill aims to rebalance supply-demand dynamics, reducing extreme price swings in both rents and valuations.

While some short-term price compression is possible in high-growth metros, long-term outlooks suggest more stable appreciation, tenant retention, and reduced vacancy risk especially for professionally managed portfolios.

What Lies Ahead

With the bill advanced from committee, it is expected to proceed through the Senate and potentially the House before becoming law. While its fate hinges on funding details and legislative negotiation, the DRIVE for systemic housing reform is stronger than ever.

Utah Real Estate Market

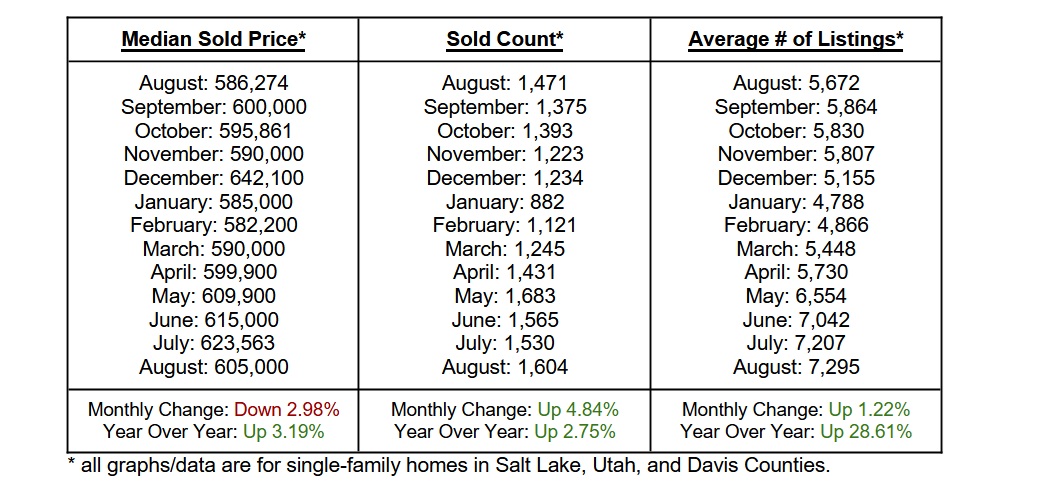

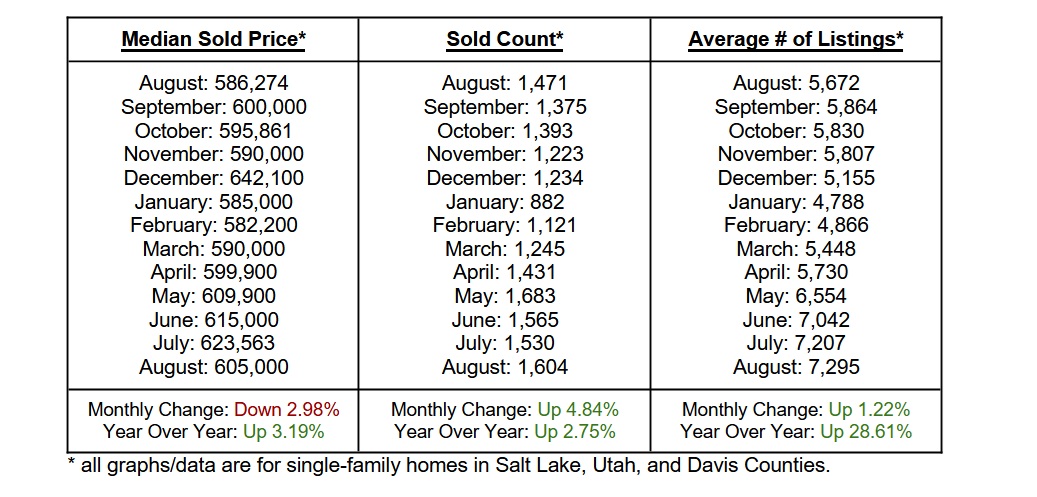

The Utah real estate market showed a slight adjustment in August, with the median sold price easing to $605,000, a 2.98% decline from July, though still 3.19% higher year over year. Sales activity picked up, with 1,604 homes sold, marking a 4.84% increase from the previous month and a 2.75% gain compared to last year. Inventory also continued to build for the fourth straight month, reaching 7,295 active listings, up 1.22% from July, giving buyers more choices and signaling ongoing normalization in the market.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

In August, Utah’s rental market remained relatively flat at the state level, with no month-over-month change in prices and a 1.9% decline compared to August 2024. County-level trends were mixed. Utah County led with a 0.5% monthly gain, while Davis County saw the steepest decline at -0.3%. In the city breakdown, West Jordan posted the strongest growth at 1.0% MoM, followed by South Jordan at 0.9%, while West Valley City recorded the sharpest drop at -3.5%. Although several cities experienced minor monthly gains, year-over-year figures remain largely negative, pointing to ongoing market adjustment across the state.

*Rental data provided by apartment list.

Industry Updates

The New Landscape of Rent and Fee Disclosure Laws in 2025 - In 2025, fee transparency mandates have emerged as a dominant legislative trend, with 26 state-level bills and multiple local proposals aiming to regulate how rental housing providers disclose fees. While the National Apartment Association (NAA) supports transparency, it warns that overly prescriptive laws could disrupt standard leasing practices. States like Colorado, Connecticut, Massachusetts, New Mexico, and Virginia have enacted new laws requiring clear disclosure of total rental costs, itemized fees, and mandated lease language—some even including penalties for noncompliance. Localities like Fayetteville, AR and Bellingham, WA have also implemented strict advertising and disclosure rules, including bans on specific fees deemed excessive. NAA argues that rental housing differs from one-time retail transactions and warns that requiring disclosure of conditional fees could confuse renters and inflate advertised prices. As federal regulators step back, state and local governments are filling the gap, prompting NAA to intensify advocacy efforts to ensure the industry’s voice is considered in ongoing policy debates.

Single-Family Rentals Predicted to Appreciate 2.5% Annually in 2025 - Zillow forecasts a 2.5% annual appreciation for single-family rentals in 2025, signaling a shift to more stable, predictable growth after years of rapid rent increases. For property owners, this means steady income potential with less volatility, especially compared to apartments, which are projected to grow just 1%. The focus now shifts to strong cash flow and tenant retention, as rent growth slows further into 2026. With long-term fundamentals in play, single-family rentals remain a solid investment choice in a cooling but still favorable market.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai