As we move into August, the economic landscape is shifting and fast. The latest jobs report came in far below expectations, inflation trends are in flux, and all eyes are on the Fed as rate cut odds surge heading into their next meeting. We’ll break down what these developments mean for real estate investors and rental property owners, explore fresh data on landlord behavior, and look ahead to what the Consumer Price Index might reveal next. Let’s dive in!

Headlines

July Jobs Report - The July jobs report revealed the U.S. economy added just 73,000 jobs, well below expectations and the estimated 80,000 needed to support population growth. More concerning were steep downward revisions to May and June figures, slashing previously reported gains of 291,000 down to just 33,000. These changes have turned what were thought to be healthy reports into signs of significant weakness. President Trump reacted by firing the BLS commissioner, claiming without evidence that the report was politically manipulated. Economists note revisions are standard, but the magnitude of these shifts underscores a rapidly cooling labor market.

Weekly Jobless Claims - U.S. weekly jobless claims rose by 7,000 to 226,000 in the week ending August 2, the highest in a month but still within a stable range. While layoffs remain limited, hiring has slowed sharply, making it harder for laid-off workers to find new jobs. Continued claims climbed to 1.974 million, the highest since November 2021, reflecting the sluggish hiring environment. The labor market is cooling, with July’s weak job creation and major downward revisions to May and June figures underscoring the slowdown. Economists describe the current state as a “no hire/no fire” environment, where employers are holding on to staff but hesitant to expand. In Utah, initial unemployment claims rose to 1,341 from 1,133 the prior week, an increase of 208 signaling some softening in the state’s labor market as well.

Consumer Price Index - The next CPI report is set to be released on August 12, which falls outside our current publication date, so we’ll cover that in our next issue. For now, here’s a quick recap of June’s data: Consumer prices rose 0.3%, with annual inflation at 2.7%, and core inflation at 2.9%. Tariff impacts were mixed, apparel and home furnishings increased, while vehicle prices declined. Shelter costs, up 3.8% year-over-year, were the biggest contributor to overall inflation. Real wages dipped 0.1% for the month. President Trump renewed calls for major Fed rate cuts, citing low inflation, but the Fed remains cautious. Markets anticipate a potential rate cut in September.

Fed Meeting - The Federal Reserve held interest rates steady at 4.25%–4.50%, despite mounting pressure from President Trump and dissent from two Fed governors who advocated for cuts. Chair Jerome Powell reiterated that no decision has been made regarding a September rate move, emphasizing that future actions will be guided by incoming economic data. While Trump continues to call for aggressive rate reductions, the Fed remains measured in its approach amid signs of slowing growth and easing inflation. Q2 GDP rose by 3%, and inflation is now hovering near the Fed’s 2% target. However, in the wake of the unexpectedly weak July jobs report, expectations shifted dramatically—the likelihood of a rate cut at the next Fed meeting surged from around 40% to more than 80%. Analysts now widely anticipate at least one rate cut in September, with the potential for a second before year‑end if labor market and inflation trends continue to soften.

Landlord Trends 2025: Fewer Buys, More Property Upgrades

Landlord sentiment in 2025 is shifting noticeably, according to newly released surveys by RentRedi and BiggerPockets. Amid rising home prices, increased interest rates, and tightening margins, fewer landlords are planning to acquire or sell properties this year. Instead, more are choosing to double down on their existing portfolios—investing in renovations, improving operational efficiency, and focusing on income stability.

This shift marks a strategic realignment of priorities, especially among small landlords and those operating in high-cost regions.

Decline in Buying and Selling Plans

Compared to data gathered in November 2024, the June 2025 survey reveals a significant pullback in acquisition activity:

The percentage of landlords planning to buy properties dropped from 67% to 53%—a 14-point decline.

Meanwhile, those planning to make no changes to their portfolios increased from 32% to 43%.

Fewer than 1 in 4 landlords expect to sell a rental property this year.

This signals a conservative stance across the market, with landlords showing caution amid economic uncertainty.

Variations by Portfolio Size

Large landlords (owning 20+ units) remain more active: over 20% still plan to both buy and sell this year.

Small landlords (owning fewer than 20 units) are more conservative: just 5% intend to buy or sell, and nearly half plan to hold steady with no changes.

Increased Spending on Property Improvements

Even though many landlords are pausing expansion, they’re not standing still. The surveys reveal a sharp uptick in planned renovation and improvement spending, with landlords opting to enhance property value, retain tenants, and boost rental income.

Spending Highlights:

The percentage of landlords planning to spend over $20,000 on upgrades jumped from 27% to nearly 35%.

Those budgeting $5,000 to $19,999 rose from 24.7% to 29.6%.

Midwest and West landlords led the trend in higher spending, with both regions experiencing 10-point increases in landlords budgeting over $20,000.

These improvements reflect a more focused investment strategy. Instead of spreading resources across new acquisitions, landlords are maximizing returns from their current holdings.

However, despite the increased willingness to spend, financial caution remains. According to the report, 50% of landlords have paused some or all planned home improvement projects for 2025. This suggests that while interest in upgrades is high, execution still depends heavily on available capital, market conditions, and rental income stability.

Why Landlords Are Holding Back from New Investments

A separate July 2025 survey by RentRedi and BiggerPockets examined the key barriers that prevent landlords from purchasing new properties. The findings help explain the strategic shift toward renovation over acquisition:

55% of respondents cited high property prices as the top reason for not buying.

23% pointed to interest rates, which remain historically elevated.

10% cited slow revenue growth in the rental sector.

11% mentioned time and management commitments, especially among self-managing landlords.

These concerns are especially pronounced among small-scale landlords, many of whom lack the scale or resources to absorb additional acquisition risk.

Landlord Goals: Revenue, Efficiency, and Stability

Landlords were also asked what they aim to achieve with their current rental operations. The top priorities were evenly split between revenue growth and operational efficiency:

34% said their main goal is to increase revenue.

Another 34% prioritized saving time and effort, which reflects growing interest in property management tools and automation.

Other goals included reducing costs and boosting property value.

Despite varying approaches, one trend holds: income generation remains the top reason for owning and managing rental properties. This is especially true among large landlords, over half of whom said income is their primary motivation. Long-term investment returns and financial freedom followed closely behind.

How Wolfnest Helps Owners Adapt in 2025

With fewer landlords buying new properties and more focusing on upgrades and efficiency, Wolfnest offers the tools and support to maximize value from existing rentals.

1. Maximize ROI

Wolfnest analyzes property performance, optimizes rent pricing, and recommends smart improvements to boost cash flow.

2. Manage Renovations

From sourcing vendors to supervising projects, Wolfnest ensures upgrades are cost-effective and aligned with tenant demand.

3. Streamline Operations

Automated rent collection, maintenance coordination, and financial reporting help owners save time and reduce stress.

4. Improve Retention

With fewer vacancies, Wolfnest focuses on tenant satisfaction and renewals to maintain steady income.

5. Offer Strategic Guidance

Wolfnest advises on budgeting, holding vs. selling, and navigating rising costs like insurance and taxes.

6. Leverage Technology

Owners benefit from dashboards, compliance tools, and automation that improve visibility and decision-making.

As the 2025 rental market shifts, landlords are adapting their strategies—pausing on acquisitions and instead focusing on maximizing the value of what they already own. Whether you're looking to Start your investment journey, Grow your portfolio, or strategically Exit, Wolfnest is here to help you stay ahead. Whether you’re a large-scale investor or managing a few doors, the message is the same: 2025 is about holding steady, improving what you already have, and preparing for smarter growth in the future.

Utah Real Estate Market

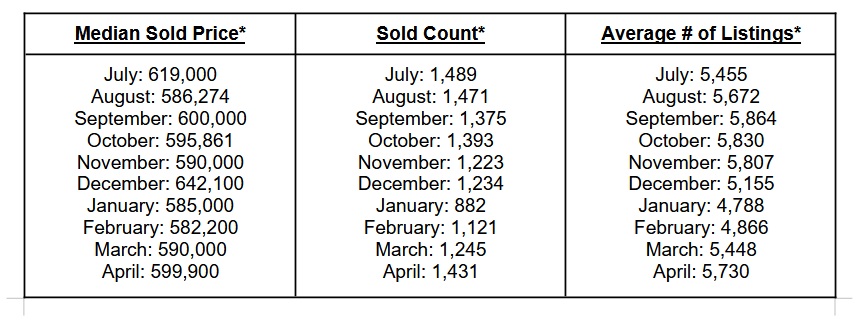

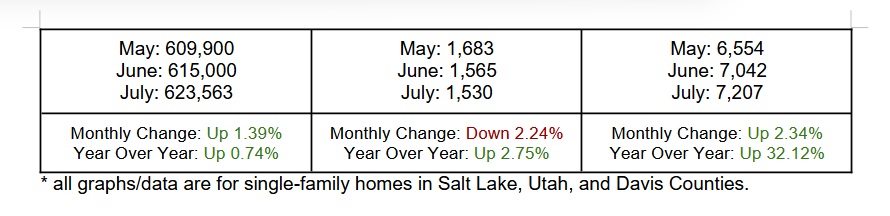

The Utah real estate market continued its steady climb in July, with the median sold price rising to $623,563, a 1.39% increase from June and a 0.74% gain year over year. While the number of homes sold dipped slightly by 2.24% compared to the previous month, sales remain higher than this time last year. Inventory also increased for the third consecutive month, reaching 7,207 active listings, up 2.34% from June and over 32% higher than last year’s July, offering buyers more options and signaling continued market normalization.

Rent Report

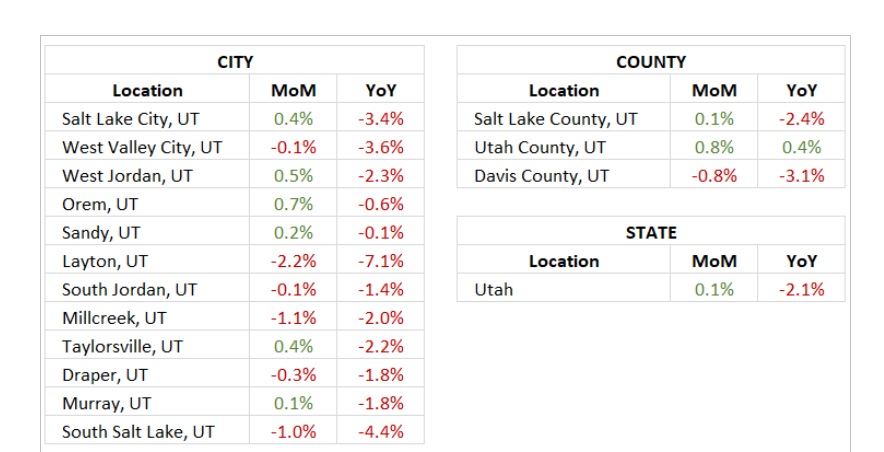

In July, Utah's real estate market showed modest month-over-month growth, with statewide prices rising 0.1%. However, year-over-year figures continue to reflect a cooling trend, with prices down 2.1% from July 2024. Most counties and cities posted slight monthly gains led by Utah County with a 0.8% increase while Davis County saw the sharpest monthly drop at -0.8%. Among cities, Orem stood out with a 0.7% MoM increase, while Layton saw the largest decline at -2.2%. Despite localized improvements, annual price changes remain negative in most areas, underscoring the market’s gradual rebalancing.

*Rental data provided by apartment list.

Industry Updates

Homeownership Slips Further Out of Reach as U.S. Renters Hit Record High - First-time homebuyers in the U.S. have dropped to a record low as high mortgage rates and soaring home prices push more Americans into the rental market. In 2024, only 1.1 million first-time buyers were recorded—380,000 fewer than the year before and nearly half the historical average. With home sales slowing, particularly in the under-$500,000 range, demand for rentals has surged, hitting a record 46 million renter households. New home construction is also declining, reflecting reduced demand from entry-level buyers. To afford a median-priced home today, a buyer would need an income of $127,000—far above the means of most renters. With Gen Z and Millennials owning homes at far lower rates than previous generations, homeownership remains out of reach for many unless mortgage rates or prices drop significantly.

Micro-housing has more than doubled in recent years - Micro-housing has more than doubled in market share over the past two decades, rising from 1.1% in the 2000s to 2.4% in the 2020s, driven not just by affordability but also changing lifestyle preferences. West Coast cities dominate the trend, with San Francisco, Seattle, Honolulu, and Portland seeing over 10% of their housing markets made up of micro-units—typically 441 square feet or less. Seattle leads with 66% of its new units classified as micro-housing. Eastern cities like Boston and Newark are also seeing a surge, with nearly half of their under-construction units falling into this category.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai