Springtime is always a busy time for rental operators. Annual lease renewals are in high gear, exterior maintenance for yards and sprinkler systems begins, and the hustle and bustle of the summer leasing season is beginning to take shape. In this month’s update, we will discuss those items as well as update you on the local real estate and rental markets, highlight a possible change in direction from the Fed, and discuss how millennial homebuying habits are influencing the rental market.

Headlines

April Jobs Report - In April, the U.S. labor market showed continued strength. Employers added 253,000 jobs, leading to a 3.4% unemployment rate, the lowest since 1969. Additionally, wage growth reached 4.4% over the past year, and the job gains were broad-based across industries. Most surprising in the data was the reversal from the cooling trend we’ve seen over the past few reports. Despite economic worries, including the failure of three banks and a pullback on lending, job creation remained robust. The Federal Reserve clearly wants to see continued softening in the labor market before pausing interest rate increases so we can only hope that inflation (as measured by the CPI report) falls enough to comfort them into a deviation from the current strategy.

Weekly Jobless Claims - Weekly jobless claims surged to a 1.5-year high as 264,000 Americans filed for unemployment benefits. The increase of 22,000 from the previous week indicates potential stress in the labor market and paints a very different picture from the April Jobs report. Despite this, the labor market remains relatively tight, with 1.6 job openings for every unemployed person. Should weekly claims continue to rise and similar cooling shows up in May’s Jobs report, the potential risk of a recession later this year could influence the Federal Reserve to pause further interest rate hikes.

April CPI - Inflation in the US continues to decelerate, with the Consumer Price Index (CPI) climbing 4.9% for the 12 months ending in April. While only slightly below the 5% increase seen in March, April’s report still marks the 10th consecutive month of slowing headline CPI rates and shows inflation at its lowest level since April 2021. As we know, in an effort to combat stubbornly high inflation, the Federal Reserve has raised interest rates 10 times since March of last year. With no Fed meeting scheduled until June, let’s hope additional positive data for May is enough to put an end to rate increases.

Fed Meeting: On May 3rd, the Federal Reserve approved its 10th interest rate increase in just over a year, raising the benchmark borrowing rate by 0.25 percent and resulting in a target range of 5%-5.25%. The unanimous decision hints at a possible end to the current tightening cycle. The post-meeting statement noticeably omitted a sentence from the March comments, which said the committee anticipated "additional policy firming" to achieve the Fed's 2% inflation goal. Despite concerns over economic growth and a banking crisis, the labor market has remained strong and inflation is still well above 2%. However, a few more jumps in weekly jobless claims or weakness in the May jobs report may mercifully bring an end to future interest rate increases.

What Can Millennial Homeownership Trends Tell Us About the Rental Market?

According to Apartment List's 2023 Millennial Homeownership Report, more than half (51.5%) of Millennials now own homes. Of interest to landlords, particularly those who are forward-thinking, is the fact that they have achieved this milestone slower than previous generations by a significant margin and the remaining millennial renters are finding homeownership increasingly unattainable. The long-term implications of this report are clear: An increasing number of people will be renting later in life, and should these trends continue into future generations, it suggests increasing demand for rentals down the road.

The report explains that millennials experienced the slowest transition from renters to homeowners, with only 42% owning homes by age 30, compared to 48% of Gen Xers, 51% of baby boomers, and nearly 60% of the silent generation. That is a near 20% shift in the past roughly 90 years. Make no mistake, the millennial generation has had a more complicated relationship with the real estate market due to economic headwinds beyond their control. The Great Recession and the COVID-19 pandemic further affected millennials' homeownership opportunities, leading to a stark divide between millennial homeowners and renters.

As a result, an increasing number of millennial renters plan to rent forever, doubling from 13.3% in 2018 to 24.7% in 2022. This timeline coincides with a rapid increase in unaffordability, which fueled by low interest rates, peaked from 2019 to 2020. In fact, when asked “Why are you waiting to buy,” 71% of respondents listed affordability concerns as the primary motive. The increasing costs of homeownership, paired with economic challenges such as student loan debt and stagnant wages, have made it difficult for many millennials to save enough for a down payment (67% have $0 in down payment savings) or qualify for a mortgage. Simultaneously, the rental market has evolved to offer more flexible living arrangements and amenities that cater to millennials' lifestyles, making renting a more appealing option in general.

As millennials establish themselves in the housing market, the challenges they faced now are likely to burden the next generation, Gen Z. With 20% of Gen Z already identifying as "forever renters," there is a growing need for multi-family housing and a potential shift in attitudes towards allowing higher density, especially in suburban areas. The construction of more multi-family units and the implementation of zoning reforms could provide relief to the rental side of the housing market and potentially offer an alternate path to homeownership but a strong “not in my backyard” sentiment will need to be overcome to gain meaningful traction.

In conclusion, while millennials have reached a homeownership milestone, the generational divide between homeowners and renters continues to grow. Unless some unforeseen “black swan” comes along that transforms homeownership into something highly accessible to future generations, this trend spells an opportunity for rental property owners who seem likely to enjoy heightened demand for their product.

Utah Real Estate Market

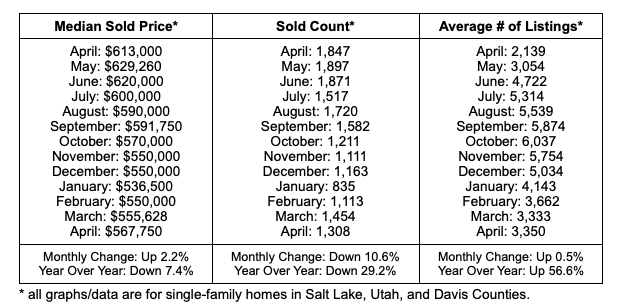

April sales for single-family homes in Salt Lake, Utah, and Davis counties were mixed with prices jumping 2.2% from March but sales dipping 10.0% and the average number of active listings remaining essentially flat from last month. The price recovery is welcome news as it marks three straight months of price gains and limits our year-over-year decline to a manageable 7.4%. The dip in closed transactions is concerning but still represents the second-highest number of completed transactions since October of last year. All in all, these are numbers we can live with but it would make many Realtors more comfortable to see a sizable jump in close transactions for May.

Utah Rent Report

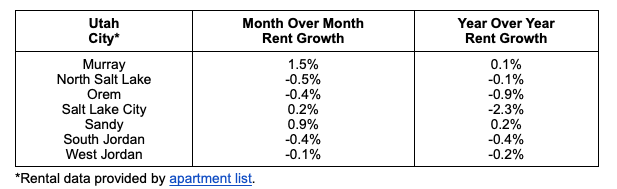

Reviewing the chart below gives one a sense that rents are finally stabilizing. With the exception of Murray and Sandy, month-over-month rent growth is mostly flat. The same is true regarding year-over-year rent growth everywhere except Orem and Salt Lake City. While a far cry from the double-digit growth we saw last summer, this is a sharp contrast from the declines we’ve seen over the past 6 months or so. We can’t dismiss the fact that this reversal could simply be a product of seasonal demand, but are hopeful rental demand picks up as we get further into summer.

Industry Updates

Rent Component of CPI Leveling Off - A new report by Apartment List economists indicates that the rent component of the consumer price index (CPI) has leveled off at 8.8% year-over-year growth in March, which is crucial to note as housing costs have been a significant driver of inflation. The report suggests that rent CPI is expected to cool steadily along with inflation in general, but the housing component continues to keep it elevated, as the "shelter" component of CPI, which includes renter-occupied and owner-occupied housing costs, comprises one-third of the overall index.

Rent Growth Climbs for Third Straight Month - Rent growth is on the rise, with the rent index increasing by 0.5% in April, marking the third consecutive month of rent growth. However, year-over-year rent growth is at its lowest since March 2021, at 1.7%, which is significantly below the pre-pandemic average. Local trends show mixed results, with 40 of the 100 largest U.S. cities experiencing negative year-over-year rent growth, while cities such as Chicago and Cincinnati saw the fastest rent growth in the past 12 months. Most local Utah submarkets are flat or slightly negative year-over-year.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai