As we step into June, leasing activity is starting to warm up along with the weather. While an uptick is common during the summer months, rental demand has been muted when compared to seasons past because market conditions are different. In this month’s update, we will dive into another key difference between the current environment and what we experienced previously - how the new administration differs from the old regarding housing policy. We will also discuss changes in the local real estate and rental markets, but first, the headlines.

Headlines

May Jobs Report - U.S. payrolls rose by 139,000 in May, exceeding expectations but slightly below April's revised figure while the unemployment rate held steady at 4.2%. Wages also beat forecasts, with average hourly earnings up 0.4% for the month and 3.9% year-over-year. Despite signs of labor market resilience, concerns linger as full-time employment dropped and past months were revised downward. With economic uncertainty from tariffs and inflation risks, the Federal Reserve is expected to maintain a cautious stance at its upcoming policy meeting.

Weekly Jobless Claims - Weekly jobless claims in the U.S. held steady at 248,000 for the week ending June 7, the highest level in eight months and a sign that layoffs may be rising. This figure, unchanged from the prior week and slightly above analyst expectations, suggests a potential softening in the labor market, which has hovered within a historically healthy range since the pandemic recovery. In Utah, new jobless claims rose to 1,576 from 1,339 the previous week, marking an increase of 237 and reflecting the broader national trend. Economists are warning of early signs of strain, especially as companies cut guidance amid trade uncertainties linked to President Trump’s tariff policies. While hiring continues, the pace has slowed, job confidence is dipping, and broader economic growth is showing signs of stress, raising concerns of a possible recession.

Consumer Price Index - U.S. inflation rose just 0.1% in May, coming in below expectations and bringing the annual rate to 2.4%, as energy prices continued to decline and tariff impacts remained muted. Core inflation which excludes food and energy, also increased 0.1% for the month and 2.8% year-over-year, both slightly under forecasts. The soft reading boosted market confidence and led to calls for the Fed to consider rate cuts, though policymakers remain cautious amid ongoing trade tensions and data collection challenges tied to federal workforce cuts.

Fed Meeting - The Federal Reserve is set to meet on June 17–18, following a May inflation report that came in cooler than expected, with consumer prices rising just 0.1% for the month and 2.4% annually. At its last meeting on May 7, the Fed held rates steady at 4.25%–4.5%, citing rising uncertainty tied to the Trump administration’s 10% tariffs and the risk of stagflation. While the labor market remained strong, early signs of slowing growth and trade-related disruptions led Fed Chair Jerome Powell to emphasize patience. With tariff impacts not yet fully reflected in pricing data, the Fed is expected to keep rates unchanged in June, while continuing to monitor inflation, employment, and trade conditions before considering adjustments later in the year.

A New Administration Means Change for Housing and Rentals

The first few months of the new presidential administration have brought notable shifts in federal housing policy. From changes in rental assistance programs and regulatory rollbacks to new priorities around tax reform and housing supply, the administration’s early actions mark a clear departure from the previous approach.

As the industry responds to these developments, it’s important to assess both the intended goals and the potential effects on rental housing providers, tenants, and the broader market.

Key Housing & Rental Policy Changes Under Trump (2025)

1. Federal Budget Cuts to HUD

What changed: The Trump administration proposed a 44% cut to the HUD budget and consolidation of five housing assistance programs into one state-administered block grant.

Impact: Estimated to reduce housing aid from 4.5 million to 2.4 million households.

2. Rental Assistance Overhaul

What changed: Proposal to cut Section 8 and federal rental aid by 40%, capping assistance for able-bodied adults at two years.

Impact: May lead to rising evictions and more pressure on local housing authorities.

3. Regulatory Rollbacks

What changed: Reversal of several Biden-era regulations including:

Disparate impact liability rule (anti-discrimination enforcement)

Rescinding HUD protections for gender identity under the Fair Housing Act

Delayed or canceled energy efficiency standards, building codes, and tenant-landlord mandates

Impact: Developers saw lower compliance costs, while tenant protections weakened.

4. NAA Advocacy Wins

The National Apartment Association (NAA) helped reintroduce:

Choice in Affordable Housing Act (to improve Section 8 program)

Respect State Housing Laws Act (removes expired CARES Act eviction notice requirements)

Pushed for LIHTC expansion and preservation of SALT deductions

Impact: Helped property owners reduce tax burdens and potentially increase affordable housing supply.

Pros and Cons of the New Administration’s Housing Policies

PROS

1. Lower Regulatory Burden for Property Owners

Rollbacks on federal landlord-tenant mandates, energy efficiency standards, and disparate impact rules have reduced compliance costs.

Impact: Developers and landlords face fewer administrative hurdles, improving project turnaround and reducing costs on operations and new builds.

2. Increased State Flexibility

Shifting from federal housing assistance to state-administered block grants gives local governments more control over how funds are used.

Impact: States can tailor programs to local needs and housing markets, potentially speeding up implementation of housing solutions.

3. Greater Tax Incentives for Investors

Continued push to preserve the 20% Qualified Business Income (QBI) deduction and SALT property tax deductions.

Impact: Real estate professionals and investors maintain important financial relief, supporting investment in rental housing.

4. Expanded Industry Engagement in Policy Reform

NAA secured bipartisan support to reform and simplify the Housing Choice Voucher (Section 8) program and promote LIHTC expansion.

Impact: Encourages more landlords to accept vouchers by reducing red tape and increasing reimbursement predictability.

5. Supply-Side Emphasis

Deregulation efforts are meant to address housing supply issues by streamlining approval and construction processes.

Impact: Could help reduce the national housing shortage if paired with strong local implementation and private sector support.

CONS

1. Reduced Federal Rental Assistance

Proposed 40% cuts to federal rental aid and time limits on support for able-bodied adults undermine housing security.

Impact: Millions of renters risk losing benefits, increasing homelessness and deepening the affordable housing crisis.

2. Weakened Tenant Protections

Rescission of rules protecting against housing discrimination (e.g., gender identity) and the rollback of CARES Act notice provisions.

Impact: Tenants may face greater risk of unfair treatment and eviction, especially in vulnerable populations.

3. Potential for Uneven Access Across States

Block grants shift responsibility to states without guarantees of equal capability or funding.

Impact: Housing support may vary widely depending on state resources and priorities, leaving low-income renters in underfunded areas more exposed.

4. Delayed Sustainability Goals

Repealing energy conservation standards and delaying efficiency mandates may hinder environmental progress in new housing development.

Impact: Long-term utility costs for renters could rise, and green building momentum may stall.

5. Increased Legal and Political Uncertainty

Rollbacks on federal protections and changes in HUD policy have triggered lawsuits and political backlash.

Impact: Prolonged legal disputes could delay implementation of reforms and create instability for developers and housing agencies.

As with any major policy shift, the first six months of the new administration have brought both opportunities and challenges for the housing and rental sectors. While some changes aim to reduce regulatory burdens and expand local flexibility, others raise concerns about affordability, tenant protections, and long-term housing stability. The full impact of these developments will depend largely on how they are implemented at the state and local levels, as well as how industry stakeholders, policymakers, and communities adapt.

Utah Real Estate Market

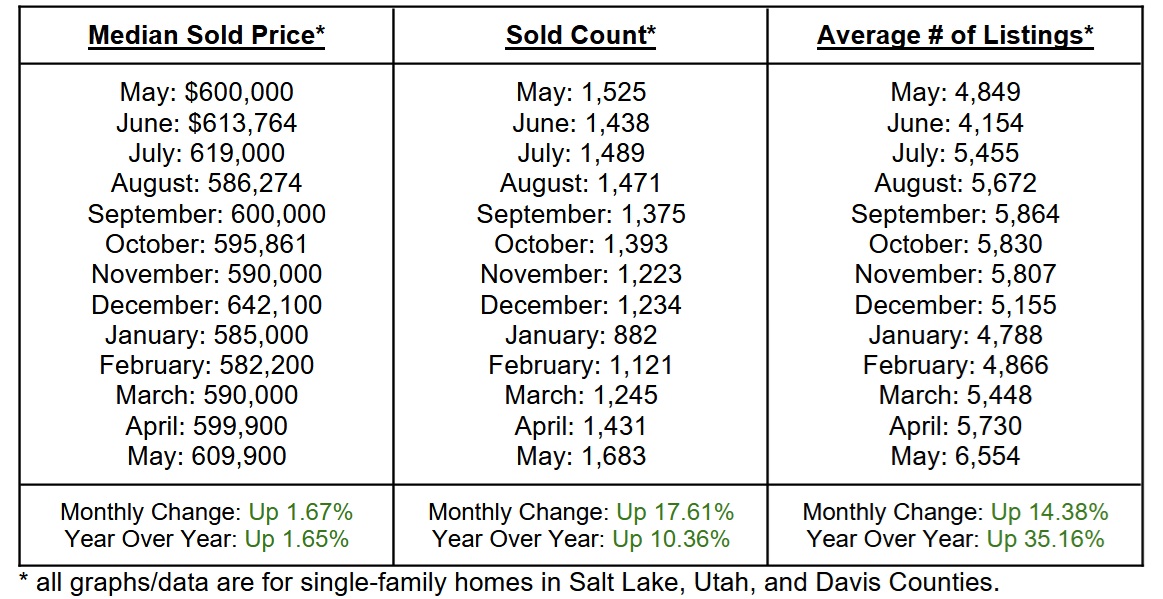

The month of May built on the momentum from April with solid gains across key market indicators, signaling continued strength as we move deeper into the peak buying season. The median sold price climbed to $609,900, up 1.67% from the previous month reflecting steady growth in home values. Sales volume also surged, rising 17.61% month-over-month and 10.36% compared to last year, highlighting increased buyer demand. However, Inventory expanded significantly as well. Together, these trends point to a competitive yet healthy market.

Rent Report

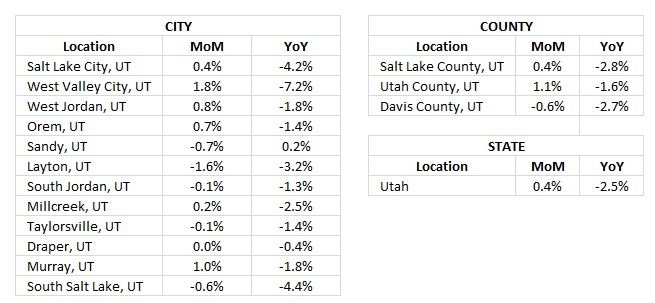

Utah’s rental market showed mixed movement in May, with modest month-over-month gains in several key cities, though year-over-year declines persist across the board. West Valley City led the month with a notable 1.8% increase, followed by strong showings in Murray (1.0%) and West Jordan (0.8%). However, cities like Layton (-1.6%) and South Salt Lake (-0.6%) saw declines, highlighting continued variability at the local level. At the county level, Utah County posted the largest monthly gain at 1.1%, while Davis County slipped by 0.6%. Statewide, rents rose 0.4%, indicating a slow but steady rebound in pricing amid broader market adjustments.

*Rental data provided by apartment list.

Industry Updates

Apartment Market Pulse Spring 2025 - The Spring 2025 Apartment Market Pulse shows strong multifamily demand despite economic uncertainty under the new Trump administration. Tariffs and federal job cuts have caused market volatility and weakened consumer confidence. Inflation remains above target, and interest rates held steady at 5.25%. Multifamily absorption outpaced new supply, pushing occupancy to 95% and rents up to $1,827. However, capital markets cooled, and Build-to-Rent activity dropped sharply due to rising costs and investor caution. Looking ahead, tight supply, high construction costs, and policy uncertainty may worsen affordability unless development rebounds.

Rent control expands in 2025 - In May 2025, Washington passed a new rent control law capping annual rent increases at 7% plus inflation (or 10% max), starting January 2026. It joins states like Oregon and California in adopting similar measures amid rising rents and a worsening housing crisis. Supporters say the law offers stability for renters, while critics argue it may deter investment and reduce housing supply. Experts stress that broader solutions—like zoning reform and affordable housing development—are still needed to fix the long-term crisis.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai