Late Wednesday, lawmakers officially ended the longest government shutdown in history at 43 days. The stalemate between Republicans and Democrats had put a stop to the regular flow of economic data that investors use to make important decisions. In other words, everything from key inflation data to jobs figures have gone unreported for the past month and a half, adding further uncertainty to an already cloudy economic picture. Hopefully, with government employees back to work, key information will begin to flow again soon.

Headlines

October Jobs Report - The record-long U.S. government shutdown has delayed the release of official labor data, but alternative indicators suggest a cooling yet stable job market. Economists estimate the October report would have shown a loss of 60,000 jobs and a rise in unemployment to 4.5%. Private data paints a mixed picture: ADP reported just 42,000 new jobs, Challenger announced the highest October layoffs in 22 years, and ISM surveys showed a contraction in both manufacturing and services hiring. Bank of America data reflected flat payroll growth and widening wage gaps, while Indeed and Homebase noted drops in job openings and small-business employment. Despite sluggish hiring, layoffs remain limited, indicating a slowdown rather than a collapse. Fed officials, including Chicago Fed President Austan Goolsbee, describe the current phase as “low hiring, low firing,” signaling caution but not recession.

Weekly Jobless Claims - Due to the recently ended government shutdown, the release of several key economic indicators including the weekly jobless claims report has been delayed. As a result, we are unable to cover jobless claims in this update but future reports are expected on the usual Thursday release schedule.

Consumer Price Index - Due to the government shutdown, the release of the latest Consumer Price Index (CPI) has been delayed, so we are unable to include new inflation data in this update. As a recap, last month’s CPI report showed inflation rising 0.3% month over month and 3.0% year over year, coming in softer than expected. Core CPI, which excludes food and energy, increased 0.2% on the month and also 3.0% annually, signaling easing price pressures. Gasoline prices jumped 4.1%, contributing heavily to the monthly increase, while food rose 0.2% and shelter costs climbed a modest 0.2%, reflecting continued cooling. Markets reacted positively to the lower-than-expected inflation figures, which strengthened expectations for a Federal Reserve rate cut. Despite tariff-related impacts on certain goods, the report suggested inflation was stabilizing, giving the Fed more room to support the softening labor market.

Fed Meeting - In the last Federal Reserve meeting scheduled from October 28–29, The Federal Reserve approved its second consecutive quarter-point rate cut, lowering the benchmark rate to 3.75%–4%, but Chair Jerome Powell cautioned that another cut in December is “far from a foregone conclusion.” The decision, approved by a 10–2 vote, came alongside an announcement that quantitative tightening will end on December 1, halting the Fed’s balance sheet reduction. Divisions within the committee reflected growing uncertainty amid limited economic data caused by the ongoing government shutdown. The Fed cited rising risks to employment, slowing job gains, and inflation holding around 3%, driven partly by energy costs and tariffs. Powell noted increasing support among Fed officials to pause further easing as they balance concerns over the softening labor market with inflation pressures. Markets initially rallied on the rate cut but turned lower after Powell’s remarks signaled a more cautious stance ahead.

Why American Housing Markets Have Stalled

The U.S. housing market stands at a crossroads — bursting with pent-up demand yet paralyzed by high costs and stalled activity. Despite millions of Americans needing homes after years of underbuilding, home sales have plunged to their lowest levels in more than three decades. Elevated mortgage rates, expensive construction inputs, and labor shortages continue to choke supply, while younger generations increasingly question the affordability of traditional homeownership. For buyers, builders, and investors alike, this moment offers both opportunity and risk in a market struggling to find its balance.

Interest Rates Impact Housing Affordability

The most significant factor stalling the U.S. housing market is the prolonged stretch of elevated mortgage rates. The average 30-year fixed rate has lingered between 6% and 7%, nearly double what buyers enjoyed just a few years ago. This surge has slashed purchasing power—households that could once afford a $500,000 home now qualify for far less, pushing many would-be buyers out of the market altogether. Meanwhile, millions of existing homeowners remain “locked in” to their ultra-low pandemic-era mortgages, typically between 2% and 3%, creating little incentive to sell. The result is a frozen resale market nationwide, where overall sales volume has tumbled to multi-decade lows.

Compounding the issue is the rise of investor activity in the single-family home sector. According to the Federal Reserve Bank of St. Louis, roughly 30% of all single-family home purchases in the first half of 2025 were made by investors, diverting a substantial share of available inventory away from traditional owner-occupiers. While some of these properties enter the rental market and help meet demand, they also tighten supply for buyers and add upward pressure to prices. Together, persistently high borrowing costs and growing investor competition have created a twofold affordability squeeze, reinforcing the imbalance between limited housing supply and strong underlying demand.

Why Is Building New Homes So Expensive?

The cost of building new housing remains stubbornly high, limiting much-needed supply. Construction materials like lumber, concrete, and copper have stayed elevated due to global supply chain issues, while labor shortages persist as the construction workforce ages and struggles to attract younger workers. Developers also face steep land costs and local zoning restrictions, particularly in urban and suburban areas, which make large-scale housing projects more difficult and expensive. In addition, high financing costs have made it more expensive for builders to take on new projects, forcing many to delay or scale back developments. As a result, new home construction remains well below demand, keeping inventories tight and preventing price correction.

Hard to Argue Against Renting

In today’s environment, renting has become the more practical option for many Americans. With home prices and mortgage rates both elevated, the monthly cost of owning often exceeds that of renting even in higher-end markets. According to U.S. News & World Report, renters typically enjoy lower upfront costs, since they avoid large down payments, closing fees, property taxes, and ongoing maintenance expenses that homeowners must shoulder. For those prioritizing predictable monthly payments and short-term savings, renting provides financial breathing room at a time when ownership costs are historically high. Rent growth has also stabilized after several years of steep increases, creating a period of relative affordability and stability for tenants. This allows renters to better manage budgets without the volatility of fluctuating mortgage rates or repair costs. For investors and property managers, this shift supports steady rental demand and low vacancy rates, especially as affordability pressures push potential buyers to remain renters longer. While owning still builds equity over time, many households are choosing flexibility and cost savings over the financial strain of buying in a high-rate market.

Bottom Line

America’s housing market has not crashed, but it has certainly stalled. High interest rates, expensive construction, and demographic shifts have created a market where demand and supply are both constrained. Prices remain elevated due to low inventory, but transaction volume is weak. Unless mortgage rates fall meaningfully or new supply accelerates, the market will likely remain in this “frozen equilibrium” — stable but sluggish, with affordability challenges persisting well into 2026.

Utah Real Estate Market

The Utah real estate market remained steady in October, showing continued resilience despite the seasonal slowdown. The median sold price dipped slightly to $600,000, down 1.64% from September but still 0.69% higher year over year, signaling stable home values. Sales activity picked up, marking a 6.92% increase from last month and a strong 10.91% gain compared to this time last year, reflecting sustained buyer demand. Active listings edged down 1.10%, keeping inventory conditions favorable for buyers. Overall, October’s numbers highlight a balanced market, moderate price adjustments paired with healthy sales momentum and robust supply.

Median Sold Price* | Sold Count* | Average # of Listings* |

October: 595,861 November: 590,000 December: 642,100 January: 585,000 February: 582,200 March: 590,000 April: 599,900 May: 609,900 June: 615,000 July: 623,563 August: 605,000 September: 610,000 October: 600,000 | October: 1,393 November: 1,223 December: 1,234 January: 882 February: 1,121 March: 1,245 April: 1,431 May: 1,683 June: 1,565 July: 1,530 August: 1,604 September: 1,445 October: 1,545 | October: 5,830 November: 5,807 December: 5,155 January: 4,788 February: 4,866 March: 5,448 April: 5,730 May: 6,554 June: 7,042 July: 7,207 August: 7,295 September: 7,288 October: 7,208 |

Monthly Change: Down 1.64% | Monthly Change: Up 6.92% Year Over Year: Up 10.91% | Monthly Change: Down 1.10% Year Over Year: Up 23.64% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

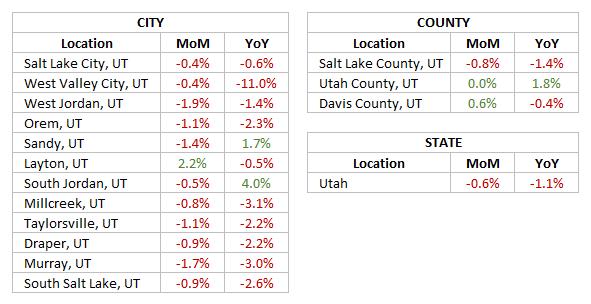

Utah’s rental market showed mild fluctuations in October, with most areas experiencing modest shifts after a steady September. At the state level, rent prices fell 0.6% month over month and 1.1% year over year, signaling continued stabilization. Salt Lake County saw a 0.8% monthly decline, while Utah County held flat and Davis County posted a slight gain. Among cities, Layton led with the strongest monthly growth, while Murray, West Jordan, and Sandy experienced the steepest drops. Year over year, South Jordan stood out with the largest increase, reflecting resilient local demand despite broader market softening. Overall, October data points to a balanced market, with minor price corrections across most regions and stable rental conditions statewide.

*Rental data provided by apartment list.

Industry Updates

26 Property Firms Settle Rent-Price Lawsuit for $141 Million - Twenty-six major property management companies, including Greystar, agreed to pay $141 million to settle a class-action lawsuit accusing them of using RealPage’s rent-setting software to coordinate pricing and inflate rents nationwide. Greystar, the largest landlord in the U.S., will contribute $50 million under the proposed settlement, which still requires court approval. As part of the agreement, the companies will stop sharing nonpublic data with RealPage, marking a significant shift in multifamily housing practices. While all parties deny wrongdoing, they will cooperate in ongoing cases against RealPage and other firms still facing antitrust claims from the Department of Justice and multiple state attorneys general. Settlement funds will be distributed to millions of affected tenants, though RealPage maintains its software is lawful and used on fewer than 10% of U.S. rental units.

Fannie and Freddie End CARES Notice Enforcement - Fannie Mae and Freddie Mac announced that they will no longer enforce compliance with the CARES Act’s 30-day notice-to-vacate rule for Enterprise-backed housing, marking a major win for rental housing providers. Effective October 8, 2025, both agencies have eliminated related compliance requirements, such as lease audits, borrower reminders, and informational notices tied to the expired CARES Act provisions. While multifamily borrowers must still comply with all applicable laws and loan terms, the change ends years of confusion caused by ambiguous federal language that prolonged enforcement beyond the law’s 2020 expiration. The National Apartment Association (NAA) praised the move, noting it will help prevent unnecessary eviction delays and restore landlord-tenant authority to the states, while continuing to advocate for legislation like the Respect State Housing Laws Act to ensure uniform notice procedures and regulatory clarity.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai