Happy New Year! As we journey into 2026, the economy seems to be finding a steadier, though slower pace. We ended 2025 with slower job growth, higher unemployment, easing inflation, and another rate cut from the Federal Reserve, but while these trends point to a more stable economic environment, higher interest rates are still playing a major role in housing and real estate decisions. This month’s update takes a closer look at how interest rates, evolving Fed policy, and early housing signals are shaping the start of the year. Together, these insights help explain where things stand today and what property owners and investors can realistically expect as 2026 unfolds. First, let’s dive into the headlines.

Headlines

December Jobs Report - Because the government shutdown delayed the release of employment reports, November is the most recent month with complete and reliable labor market data released last December 16. U.S. payrolls rose by 64,000 in November, exceeding expectations but coming after a sharply revised 105,000 job loss in October, pointing to a cooling labor market. The unemployment rate increased to 4.6%, its highest level since 2021, while underemployment climbed to 8.7%, with most job gains concentrated in health care. Government layoffs largely drove October’s decline, wage growth remained subdued, and markets continue to assign low odds to another Federal Reserve rate cut in January as policymakers balance weakening employment trends against inflation risks.

Weekly Jobless Claims - Unemployment claims rose slightly at the end of 2025, indicating that layoffs remain low even as the job market cools. In the most recent release, initial claims increased by 8,000 to 208,000 for the week ending December 27, largely due to normal holiday reporting. Employers remain cautious about hiring, and while announced layoffs increased in 2025, mainly in government and tech, widespread job losses have not occurred. Fewer job openings and more people staying on benefits point to slower hiring as 2026 begins. Utah data reflects a similar pattern. Initial unemployment claims increased to 1,596, up from 1,456 the prior week, an increase of 140 claims. While this shows a modest uptick, claim levels remain relatively low by historical standards, suggesting Utah’s labor market is slowing gradually rather than weakening sharply as the new year begins.

Consumer Price Index - CPI reporting has also been disrupted by the government shutdown, with the October CPI fully canceled and any usable data folded into November, making November the most current and consolidated inflation snapshot available. In the delayed report, consumer prices rose 2.7% year over year, below expectations of 3.1%, while core CPI increased 2.6%, also cooler than forecast. Monthly inflation slowed to 0.2%, and shelter inflation eased to 3%, signaling progress toward the Fed’s 2% target. Although economists urged caution due to missing October comparisons, markets reacted positively, reinforcing expectations that the Federal Reserve may shift focus toward supporting a softening labor market rather than cutting rates immediately.

Fed Meeting - The next Federal Reserve meeting is scheduled for January 27–28 and will be covered in the next publication. In the meantime, here’s a recap of key takeaways from last month’s meeting. The Fed cut interest rates for the third time this year, lowering them by 0.25% to a range of 3.5%–3.75%, but signaled that additional cuts will come at a much slower pace. The decision highlighted internal divisions, with some officials pushing to support the job market and others remaining cautious due to persistent inflation. Looking ahead, the Fed currently expects just one more rate cut in 2026 and another in 2027, reflecting a careful, data-driven approach. Policymakers also noted that while economic growth is expected to continue, inflation may remain above the 2% target for some time. Additionally, the Fed announced plans to resume buying Treasury bills to help maintain stability in financial markets as they monitor economic and labor market conditions.

How We’re Starting 2026: Rates, Policy, and the Reality Facing Housing Today

Last month, we focused on What Property Owners Should Expect in the 2026 Rental Market, looking ahead at rental trends, supply constraints, and strategic considerations for the year. To begin 2026, we’re grounding that outlook in where the market actually stands right now, using recent national reporting on interest rates, Federal Reserve policy, and early housing signals to frame how the year is taking shape.

Interest Rates: “Higher for Longer” Is Still the Starting Point

According to Yahoo Finance, economists and housing analysts agree that mortgage rates are unlikely to fall quickly or dramatically. While inflation has come down from its peak, rates are likely to remain elevated, with only limited or gradual declines expected in the near term. Importantly, it notes that even future cuts would likely leave borrowing costs well above pre-pandemic norms.

For housing and real estate investing, this reinforces a key reality: affordability remains constrained, buyers remain selective, and investors must underwrite deals with conservative financing assumptions. This environment continues to suppress transaction volume, slow home sales, and keep many would-be buyers in the rental market longer.

Federal Reserve Policy: Caution, Not Urgency

Where rates go next really depends on what the Federal Reserve decides to do. According to Realtor.com, the Fed is taking a more careful, wait-and-see approach right now.

Inflation is still higher than their 2% goal, and with leadership changes coming up, there’s extra uncertainty in the mix. Instead of rushing into big rate cuts, Fed officials are focusing on being patient and letting economic data guide their decisions.

What that likely means is smaller, slower rate changes, if any, designed to keep the economy steady without causing inflation to flare up again. For property owners, it’s best to plan as if higher rates are here to stay for a while, rather than counting on quick relief from cheaper borrowing.

Housing Market Outlook: Slow Improvement, Not a Boom

Even with interest rates still on the high side, the housing market isn’t expected to stay stuck forever. In an article titled “Housing Market Set for a 2026 Comeback,” the National Association of Realtors points to early signs that things are starting to stabilize.

There’s still a lot of built-up demand from buyers and sellers who hit pause when rates were more unpredictable. As soon as affordability improves—even a little—or confidence picks up, more people could start making moves again.

That said, NAR is clear that any rebound will likely be slow. Limited inventory, higher borrowing costs, and cautious consumers mean we’re unlikely to see a sudden spike in sales. Instead, the market is expected to ease back into a more normal rhythm, with activity picking up gradually rather than all at once.

What This Means for Property Owners at the Start of 2026

For owners, this means financing will likely stay more expensive than it was in past years. Refinancing opportunities may be limited, and any new purchases will need to be approached more conservatively. In the near term, strong cash flow matters more than betting on quick appreciation.

On the rental side, high mortgage costs are still keeping many would-be buyers in the rental market. That continues to support rental demand, especially among households delaying homeownership. Owners who focus on keeping good tenants, pricing rentals realistically, and maintaining property quality are likely to be in a stronger position. Because rent growth will vary by market and property type, local data, and smart positioning will matter more than national headlines.

While the housing market may show some improvement later in the year, it’s best to plan for steady conditions rather than a fast rebound. Early 2026 favors patience, stability, and long-term thinking, rewarding owners who focus on dependable income, disciplined operations, and flexibility as market conditions continue to evolve.

Utah Real Estate Market

As we close out the year, the Utah real estate market shows a seasonal reset paired with encouraging signs of renewed activity. The median sold price rose to $610,000, reflecting a 1.68% monthly increase, though prices remain 5.0% lower year over year, highlighting affordability adjustments that have unfolded throughout the year. Sales activity rebounded meaningfully, with sold count up 20.02% from November to 1,397 transactions, signaling stronger buyer engagement as year-end opportunities emerged. Inventory pulled back sharply to 5,515 active listings, a 22.44% monthly decline, while still standing 6.98% higher than last year, suggesting improved balance compared to early 2024. Overall, December closes the year with firmer pricing, improved sales momentum, and tightening inventory, setting a constructive tone as the market transitions into the new year.

Median Sold Price* | Sold Count* | Average # of Listings* |

December: 642,100 January: 585,000 February: 582,200 March: 590,000 April: 599,900 May: 609,900 June: 615,000 July: 623,563 August: 605,000 September: 610,000 October: 600,000 November: 599,945 December: 610,000 | December: 1,234 January: 882 February: 1,121 March: 1,245 April: 1,431 May: 1,683 June: 1,565 July: 1,530 August: 1,604 September: 1,445 October: 1,545 November: 1,164 December: 1,397 | December: 5,155 January: 4,788 February: 4,866 March: 5,448 April: 5,730 May: 6,554 June: 7,042 July: 7,207 August: 7,295 September: 7,288 October: 7,208 November: 7,111 December: 5,515 |

Monthly Change: Up 1.68% | Monthly Change: Up 20.02% Year Over Year: Up 13.21% | Monthly Change: Down 22.44% Year Over Year: Up 6.98% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

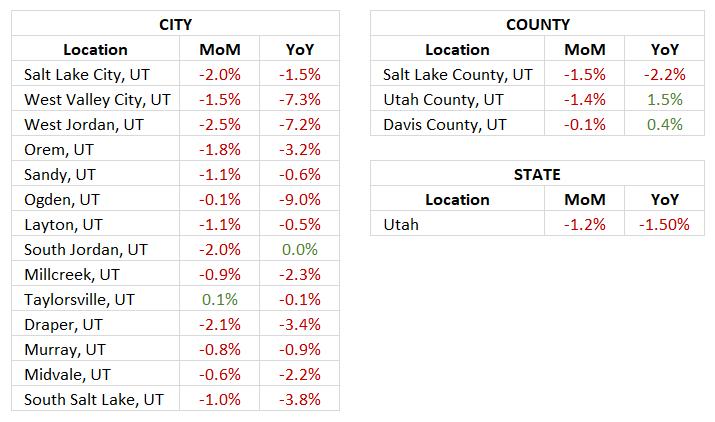

Utah’s rental market wrapped up the year with some softening, but nothing extreme. Overall rents dipped about 1.2% from the previous month and are down roughly 1.5% compared to last year. This looks more like a normal cooling period than a sudden downturn. Looking closer by county, Salt Lake County saw a slightly larger monthly pullback, with rents down 1.5%. Utah County held up better, posting only a small monthly dip and still showing year-over-year growth, making it the strongest county on an annual basis. Davis County stayed mostly steady, with very little month-to-month change and modest annual growth. At the city level, most areas saw small monthly declines, especially places like West Jordan, Draper, South Jordan, and Salt Lake City. These shifts suggest landlords are continuing to fine-tune pricing as supply and demand come back into balance. Taylorsville was a bit of an outlier, standing out as the only city with a slight rent increase for the month. Overall, December closed out the year with the market cooling in a controlled way. The trend points to steady normalization, pockets of local stability, and a few areas still outperforming on a yearly basis as we head into the new year.

*Rental data provided by apartment list.

Industry Updates

Multifamily Will Be Tested In 2026 - The multifamily housing industry is expected to face some challenges in 2026 as demand weakens due to slower job growth and reduced immigration, according to Yardi Matrix’s 2026 Winter Outlook. While the year may start slowly, the report notes some positives, including better tenant retention, fewer new apartments being built, and improving investor and lender confidence. Rent growth is expected to remain modest, with a national forecast of 1.2%, as excess supply is gradually absorbed and the economy stabilizes. Yardi Matrix expects stronger performance later in the year, especially if job growth improves and interest rates come down. About 400,500 new apartment units are projected to be delivered in 2026, enough to keep rents from rising sharply but not enough to cause major stress. Overall, while growth may be uneven and demand slower, the report does not point to a major recession, suggesting a cautious but stable outlook for multifamily housing.

Rent Control Continues Stalling Housing Supply - Rent control is emerging as a major barrier to new housing development, with Montgomery County, Maryland serving as a clear example. After the county enacted rent control in July 2024, new apartment construction slowed dramatically, with building permits for projects of five or more units plunging from over 2,000 in the first eight months of 2024 to just 54 during the same period in 2025. Industry experts point to rent control—combined with already high interest rates and construction costs—as discouraging developers from starting new projects. Similar patterns were seen in St. Paul, Minnesota after rent control was introduced, where permits fell sharply before the policy was later amended. In contrast, regions with more development-friendly policies, such as parts of Texas and the Southeast, have seen stronger construction activity and improved rental affordability due to increased housing supply.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai