As we move through the early part of the year, both the rental and sales markets in Utah are noticeably cooler than the weather. In many ways, both markets are doing what they always do this time of year, which is remain partially frozen until the inevitable spring thaw. Home prices, rental rates, and collection percentages are all mostly flat while seasonal demand is characteristically low, but we expect activity to pick up as the weather warms. Until then, there is plenty happening in economic news and in the current legislative session that is worth keeping on your radar.

Headlines

January Jobs Report - The U.S. labor market showed a clear shift in momentum heading into 2026. December closed on a soft note, with payrolls rising by just 50,000 and revisions confirming that much of the past year was marked by weak hiring despite steady economic growth. While the unemployment rate dipped to 4.4%, job gains for 2025 averaged only 49,000 per month, reinforcing concerns about a prolonged hiring slowdown. By contrast, January delivered a stronger and more encouraging picture. Payrolls increased by 130,000, more than double expectations and notching the best monthly gain in over a year. Meanwhile the unemployment rate edged down to 4.3% and broader unemployment fell to 8%. Compared with December’s sluggish finish, January suggests the labor market may be stabilizing and entering 2026 on more stable ground.

Weekly Jobless Claims - In the week ending February 7, seasonally adjusted initial jobless claims totaled 227,000, a decrease of 5,000 from the previous week’s revised level, signaling that the U.S. labor market continues to stabilize. While new claims declined, continuing claims increased to 1.862 million, indicating hiring remains somewhat tepid. January job growth improved and the unemployment rate edged down to 4.3%, though overall gains last year were minimal. In Utah, initial claims rose to 1,725 from 1,607 the prior week, an increase of 118 claims, reflecting slight week-over-week movement consistent with broader national trends.

Consumer Price Index - Inflation remained relatively steady at the end of 2025, with December showing modest easing but no clear signal for immediate rate cuts. Core CPI rose 0.2% for the month and 2.6% year over year, while headline inflation held at 2.7%, driven in part by persistent shelter costs. January delivered more encouraging news, as headline CPI slowed to 2.4% and core CPI eased to 2.5%, marking the lowest levels since mid-2025. Monthly inflation stayed contained, shelter cost growth moderated, and several key household expenses, including energy, showed signs of cooling. Overall, inflation continued its gradual downward trend from December to January, improving the outlook for potential rate cuts later in the year, even as inflation remains slightly above the Fed’s 2% target.

Fed Meeting - On January 28, 2026, the Federal Reserve held its benchmark interest rate steady at 3.5%–3.75%, pausing after three consecutive rate cuts as economic conditions improved. Officials noted solid economic growth, stabilizing unemployment, and still-elevated inflation near 3%, suggesting risks between inflation and labor markets are now more balanced. Markets expect the Fed to wait until at least June before making further adjustments. Two governors dissented, favoring another rate cut, while most policymakers supported holding rates unchanged. The decision comes amid political tensions surrounding Chair Jerome Powell’s final months in office and ongoing concerns about the Fed’s independence. Overall, the Fed signaled a cautious, data-driven approach as it evaluates future policy moves.

2026 Legislative Session - Week 1

As the legislative session moves forward, several bills are advancing that could directly affect rental housing providers across Utah. From property management licensing reforms to expanded pricing regulations and potential rent payment reporting requirements, lawmakers are considering changes that may reshape compliance responsibilities for owners and managers. While some proposals aim to increase transparency and consumer protection, they also carry operational and cost implications for the rental housing industry. The Rental Housing Association of Utah (RHA) is actively engaged with legislators and regulators to ensure these measures balance accountability with practical implementation. Below is a breakdown of the key bills and what they could mean for rental property owners and managers.

1. Property Management Licensing — HB 377 Real Estate Amendments

Representative Neil Walter (R-St. George) is sponsoring HB 377, a bill that amends Utah’s real estate laws and clarifies definitions, licensing, and regulatory authority related to real estate practice, including property management. The bill is focused on clarifying licensing language and gives the Utah Division of Real Estate authority to develop regulations rather than imposing many details directly in statute. Most specifics about how property managers will be regulated (including licensing requirements and guardrails) will be determined later by the Division through administrative rules, which RHA is actively discussing with the Division.

This effort builds on ongoing reform to property management licensing in Utah including the broader push to create a dedicated property manager license category and separate regulatory path (rather than requiring a standard real estate sales license for property management).

2. HB 29 Unfair and Deceptive Pricing Act

HB 29, sponsored by Representative Tyler Clancy (R-Provo), creates a new Unfair and Deceptive Pricing Act intended to prohibit hidden or misleading pricing and empower the Utah Division of Consumer Protection to enforce clear pricing requirements. The bill:

Requires clear, conspicuous disclosure of total prices in offers or advertisements.

Gives the Division the power to investigate violations, seek court relief, and impose fines.

Adds a new chapter (Chapter 82) to Utah’s consumer protection code.

RHA’s concern is that the expanded powers for the Consumer Protection Agency could reach into rental housing pricing practices, potentially impacting housing operators. RHA supports transparency but is working with the bill sponsor, the Consumer Protection Division, and the Attorney General’s Office to ensure rental listings can continue to reference additional details elsewhere without overly burdensome requirements.

3. SB 76 Residential Rental Payment Reporting Amendments

Senator Jen Plumb (D-Salt Lake City) is sponsoring SB 76, which would establish residential rent payment reporting provisions. The bill would allow rental owners to offer tenants the opportunity to have their rent payments reported to national credit bureaus, with specific limitations:

Owners may offer rent reporting at the time the rental agreement is signed.

Owners can charge a fee that cannot exceed actual reporting costs.

Renters may enroll or unenroll at any time; if they opt out or fail to pay the fee, they may not reenroll for six months.

The offer is optional and cannot be treated as a lease violation or eviction basis if refused or not paid.

Applies to entities owning one or more rental units or individuals owning 16+ units, and would take effect January 1, 2027.

RHA opposes the bill in its current form, arguing it could impose undue administrative burdens and costs on rental operators, and is discussing alternatives with the sponsor.

Utah Real Estate Market

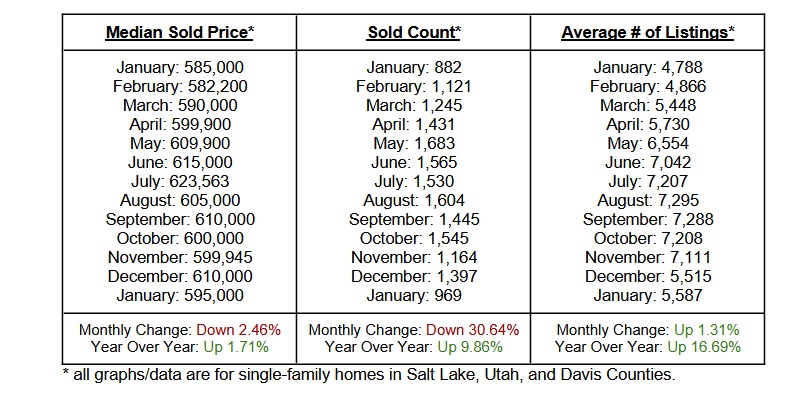

As the new year begins, Utah’s housing market is settling into its typical winter rhythm. The median sold price dipped to $595,000, down slightly from December, but it’s still higher than this time last year, showing that home values remain steady overall. Sales slowed to 969 closings, which is normal for January, yet activity is still stronger than it was a year ago, a sign that buyers are still engaged despite seasonal slowdowns. Meanwhile, inventory inched up to 5,587 active listings, giving buyers more options compared to last year. Overall, January feels less like a downturn and more like a seasonal reset, with steady pricing and improving supply laying the groundwork for a more active spring market ahead.

Rent Report

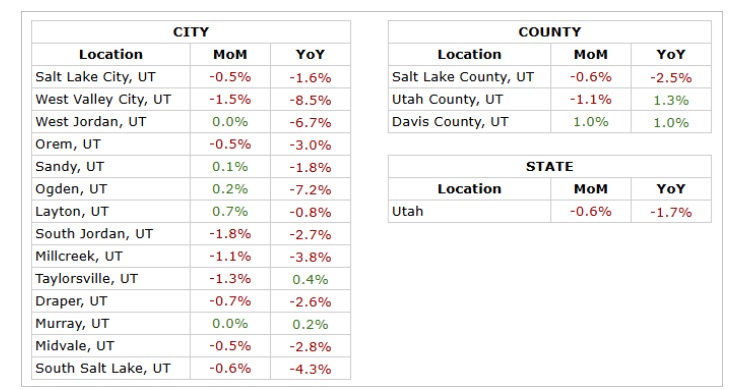

Utah’s rental market is continuing to adjust as we move into the new year. Statewide, rents dipped 0.6% month over month and are down 1.7% compared to this time last year, reflecting a steady rebalancing rather than a sharp decline. At the county level, Salt Lake County saw a modest pullback both monthly and annually, Utah County continues to stand out with the highest year-over-year growth, and Davis County posted gains both month over month and year over year. City trends show a mixed but stable picture. Most areas experienced slight monthly decreases including Salt Lake City, West Valley, and Draper but a few cities like Layton, Ogden, and Sandy posted small monthly increases. On a yearly basis, most cities remain slightly below last year’s rent levels, though a couple of pockets like Murray and Taylorsville are holding steady or seeing minor gains. Overall, the market feels measured and controlled, with landlords adjusting pricing carefully as supply and demand continue to find balance heading into spring.

*Rental data provided by apartment list.

Industry Updates

Advocacy Results for Rental Housing - The National Apartment Association (NAA) reported significant advocacy wins for the rental housing industry in 2025. Key accomplishments included the passage of a new federal tax law that strengthened housing incentives, such as making the 20% pass-through deduction permanent, expanding the Low-Income Housing Tax Credit, and extending Opportunity Zones while avoiding new taxes or penalties on rental operators. Congress also advanced major housing legislation, including the largest Senate housing package in decades, aimed at boosting supply and reducing regulatory barriers. On the regulatory front, NAA secured more than a dozen deregulatory wins across multiple federal agencies, easing compliance burdens related to eviction notices, energy standards, tenant screening, fees, and reporting requirements. Looking ahead to 2026, NAA plans to build on bipartisan housing momentum while opposing rent control efforts and pushing to fully end federal CARES Act notice requirements, returning landlord-tenant authority to the states.

Rent Control Continues Stalling Housing Supply - A new report from Apartment List finds that the rental market’s traditional peak season is becoming less pronounced and shifting earlier in the year. Historically, most moves and rent growth occurred in the spring and summer, but those sharp seasonal swings are flattening as rental activity spreads more evenly throughout the calendar year. This change is driven by lingering pandemic-related shifts, multifamily operators intentionally staggering lease renewals, and a supply-rich market that gives renters more flexibility and negotiating power. Renters are now starting their searches earlier, often in the first quarter and more move-ins are happening between January and May, rather than being concentrated in late summer. While some of this trend may ease as new construction slows, factors like remote work and operator strategies suggest that altered rental seasonality may persist even as the market tightens again.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai