As the snow melts away and April brings warmer temperatures, our focus shifts from winter process improvements to preparing for the spring leasing and renewal season. In this update, we'll delve into recent trends in job growth, inflation, and examine the implications of the Corporate Transparency Act (CTA) on property owners. But first, let's take a moment to catch up on the latest headlines.

Headlines

March Jobs Report - Despite economists' predictions of a slowdown in job growth and labor market weakening due to multiple interest rate hikes, the March jobs report defied expectations, with employers adding 303,000 jobs, lowering the unemployment rate to 3.8%. This unexpected strength underscores the remarkable resilience of the U.S. labor market amid high interest rates and elevated inflation. Furthermore, the report indicates an easing of inflationary pressures, with annual wage gains slowing to 4.1%. Industries such as health care, government, leisure and hospitality, and construction were key drivers of job growth last month. Notably, the U.S. labor market remains historically strong, with 39 consecutive months of job gains and the unemployment rate below 4% for 26 consecutive months.

Weekly Jobless Claims - The latest report from the Labor Department indicates that initial claims for unemployment benefits in the United States fell by 11,000 to 211,000 for the week ending April 6, surpassing economists' expectations of 215,000 claims. However, the figures can be volatile during this period due to factors like Easter, Passover, and spring breaks affecting public school schedules. Despite multiple interest rate hikes by the Federal Reserve aimed at curbing inflation, the labor market remains robust, with job growth accelerating in March and the unemployment rate dropping to 3.8%. This strength in the labor market is contributing to sustained inflationary pressures, particularly in service prices. In addition to the national data, the weekly jobless claim for Utah shows that initial claims for unemployment benefits advanced to 1,293, marking an increase of 102 claims from the previous week's figure of 1,191.

Consumer Price Index - The consumer price index (CPI) rose by 0.4%, surpassing expectations, driven by higher costs for gasoline and rental housing. This marked the third consecutive month of increasing CPI readings, following news of accelerated job growth. Gasoline prices rose by 1.7%, while shelter costs, including rents, also increased by 0.4%. Food prices rose modestly by 0.1%, with some fluctuations in grocery food inflation. Over the past 12 months, the CPI increased by 3.5%, the most significant gain since September. Core CPI, excluding food and energy, also rose by 0.4%, indicating broad-based inflationary pressures across various sectors, including rents, motor vehicle insurance, healthcare, apparel, and personal care. Despite some fluctuations, the overall trend suggests that the disinflationary trend has virtually stalled in recent months, prompting financial markets to adjust their expectations for rate cuts, with a minority of economists foreseeing the window for rate cuts closing.

Fed Meeting - In the last March 20 meeting, the Federal Reserve maintained interest rates at current levels and hinted at multiple rate cuts by the end of 2024. Fed officials were projecting three quarter-percentage point cuts without specifying timing, but with the recent reported increase in the consumer price index (CPI), financial markets now expect the Federal Reserve to delay cutting interest rates until September. This shift in expectation follows the strong CPI readings and suggests a cautious approach by the Fed towards monetary policy adjustments. With inflationary pressures persisting and CPI rising more than expected, the Fed may prioritize maintaining interest rates to mitigate inflationary risks. This decision aligns with Chair Powell's stance on adjusting rates based on economic data, indicating that the Fed is closely monitoring inflation dynamics before considering rate cuts.

Corporate Transparency Act

In 2024, we saw a transformative regulatory shift impacting small businesses and property owners alike with the enactment of the Corporate Transparency Act (CTA). This sweeping federal law, mandates small businesses with revenues below $5 million or with 20 or fewer employees to disclose ownership and control details to the Financial Crimes Enforcement Network (FinCEN). For landlords, property owners, and board members of various residential associations, understanding the implications of the CTA is crucial as it reshapes the landscape of business and property ownership.

Understanding the CTA

The Corporate Transparency Act (CTA) mandates small businesses to continuously update information about their owners, requiring reports for any changes such as owner relocation, establishment of new DBAs, or formation of subsidiaries. This strict law primarily targets small businesses and warns of significant penalties, including hefty fines and potential criminal charges, for non-compliance. Effective from 2024, the CTA compels businesses to file Beneficial Ownership Information (BOI) Reports with the Financial Crimes Enforcement Network (FinCEN).

Who Needs to Report?

The Corporate Transparency Act (CTA) mandates most U.S.-registered corporations, including property ownership entities like limited liability companies, to disclose information about their "beneficial owners" to the Financial Crimes Enforcement Network (FinCEN) under the U.S. Treasury. Reporting requirements are determined by whether the rental company had to file establishment documents.

neficial Owner?

Beneficial owners are defined as individuals who either possess more than 25% ownership in the company or wield significant control over its operations. It's crucial to understand that even if your rental properties are held within a trust or another entity, ultimately under an LLC, the individuals managing those entities must be revealed as beneficial owners. Similarly, for condominium, cooperative, and homeowners association members, if you exert substantial influence over critical decisions affecting the reporting company, such as serving on the board, you are likely subject to the reporting obligations outlined in the Corporate Transparency Act (CTA).

Exemptions

Minor Child: Instead of listing children as Beneficial Owners, the parent or guardian must be listed until the child reaches adulthood.

Nominee, Intermediary, Custodian, or Agent: Individuals acting solely on behalf of a beneficial owner as agents are exempted from being listed as Beneficial Owners, although the underlying beneficial owner must still be disclosed.

Employee: Employees who lack substantial control over the business are exempted, provided they meet specific criteria outlined in the law.

Inheritor: Individuals slated to inherit ownership interest in the future need not be listed initially but must be included once they inherit.

Creditor: Persons holding a security interest in the assets of a reporting company solely due to debt are exempted from being deemed Beneficial Owners.

These exceptions apply to individuals listed on a Beneficial Ownership Information (BOI) Report, distinguishing them from exemptions granted to entire businesses.

Company Applicants

A Company Applicant, as defined by the Corporate Transparency Act, is an individual who initiates the formation or registration of a Reporting Company in the United States. This includes individuals who file Articles of Incorporation or Organization. Reporting Companies formed or registered after January 1, 2024, must disclose Company Applicants, whereas those established before this date are exempt. Company Applicants are required to provide specific information as outlined in the relevant section of the Beneficial Ownership Information (BOI) Report.

Reporting Deadlines and Penalties

Under the Corporate Transparency Act (CTA), existing companies must file their initial reports with FinCEN within one year from January 1, 2024, while new entities formed after this date have 30 days (extended to 90 days in 2024) to submit their initial paperwork. Any changes in beneficial ownership must be reported within 30 days. Failure to comply with the CTA may lead to severe civil and criminal penalties, including fines of up to $10,000 and imprisonment for up to two years.

If you have questions, please consult your attorney for full details.

Utah Real Estate Market

In March, the Utah real estate market not only witnessed a moderate increase in median sold price, rising to $583,000, reflecting a month-over-month change of 0.35%, but also saw an increased sold count of 1,313 properties, indicating a significant 10.99% increase from the previous month. Additionally, despite a slight decrease in the average number of listings to 3,552, the spring sales market maintained a healthy year-over-year growth rate of 6.57%. These combined metrics highlight the market's resilience and continued upward trajectory, suggesting stability and positive momentum within the Utah real estate landscape.

Median Sold Price* | Sold Count* | Average # of Listings* |

March: $555,628 April: $567,750 May: $585,000 June: $590,000 July: $590,000 August: $586,000 September: $590,850 October: $575,000 November: $ 562,750 December: $549,850 January: $550,000 February: $580,990 March: $583,000 | March: 1,454 April: 1,308 May: 1,518 June: 1,522 July: 1,372 August: 1,451 September: 1,130 October: 1,192 November: 1,034 December: 1,052 January: 980 February: 1,183 March: 1,313 | March: 3,333 April: 3,350 May: 3,480 June: 4,022 July: 5,522 August: 4,801 September: 5,121 October: 5,166 November: 4,809 December: 4,377 January: 3,755 February: 3,580 March: 3,552 |

Monthly Change: Up 0.35% | Monthly Change: Up 10.99% Year Over Year: Down 9.70% | Monthly Change: Down 0.78% Year Over Year: Up 6.57% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

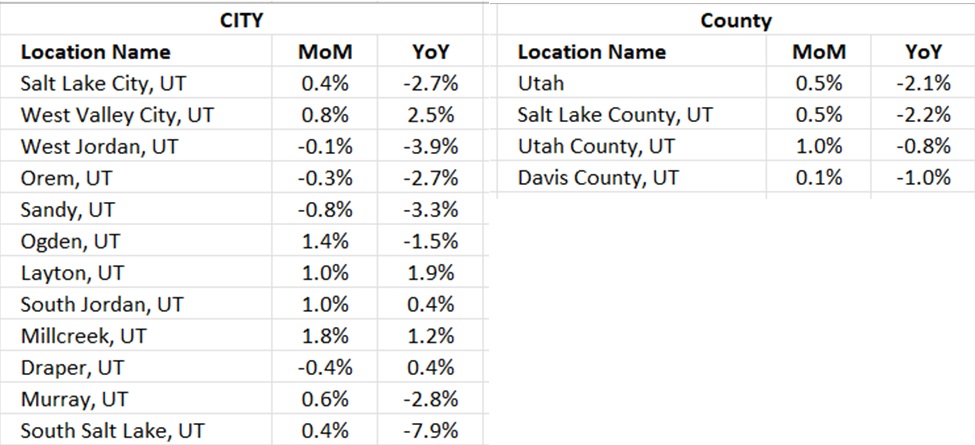

In the latest assessment of rental market dynamics across cities in Utah, distinct patterns have emerged. Among the 12 submarkets analyzed, 8 saw month-over-month increases in rental prices, with the highest gains observed in Millcreek, Layton, and South Jordan. Conversely, 4 cities experienced declines, with the most notable decrease occurring in Sandy. Year over year, the rental market presents its unique trajectory, with varying trends across different locations. While some cities recorded positive year-over-year growth, others saw declines. These trends underscore the dynamic nature of the state's housing landscape, signaling both opportunities and challenges for renters and landlords alike.

*Rental data provided by apartment list.

Industry Updates

Rent Stabilization Is Just Another Word For Rent Control - In his critique for the American Institute For Economic Research, Jason Sorens addresses the contentious issue of rent control, particularly in the context of Washington State's proposed legislation. He argues that rebranding rent control as "rent stabilization" does not alter its fundamental flaws. Sorens warns against the adverse consequences of capping rent increases at 7% annually, emphasizing the potential harm to renters, especially those with lower incomes and highlights the detrimental effects of such policies, including reduced housing availability and lower maintenance standards. Ultimately, Sorens take is an interesting counterpoint to the opinions of those advocating for rent control policy.

Treasury Announces Housing Supply Actions - The U.S. Department of the Treasury announced policy changes on March 5, 2024, aimed at bolstering housing supply nationwide, following similar actions by the White House. Updates to guidance for State and Local Fiscal Recovery Funds now allow for the construction of affordable housing, extending eligibility to families earning up to 120 percent of the area median income. Additionally, funds from the Emergency Rental Assistance 2 program can be used for affordable housing for very low-income households after certain thresholds are met. Treasury's Federal Financing Bank will continue supporting a risk-sharing partnership with HUD and housing finance agencies, facilitating the origination of HUD-insured mortgages for affordable housing construction and rehabilitation. The National Apartment Association (NAA) applauds these efforts, emphasizing the importance of addressing the affordable housing shortage.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai