In this update, we have an exciting announcement that’s been months in the making. Before we dive into the specifics, let’s begin by addressing the recent economic shifts, including the increasing pressure for a rate cut and ongoing debates around rent caps.

Headlines

July Jobs Report - In July, U.S. job growth was significantly lower than anticipated, with nonfarm payrolls increasing by just 114,000 compared to the expected 185,000, and down from June's revised 179,000. The unemployment rate rose to 4.3%, its highest since October 2021. Stock market futures fell, and Treasury yields dropped following the report.This indicates a significant slowdown in job growth, raising concerns about the broader economic health. The higher-than-expected unemployment rate and lower wage growth contribute to fears of an economic downturn. The Sahm Rule activation underscores recession risks, further pressuring the Federal Reserve to consider rate cuts to support the economy.

Weekly Jobless Claims - Initial jobless claims fell to a seasonally adjusted 233,000 for the week, down 17,000 from the previous week and below the Dow Jones estimate of 240,000. This positive labor market sign turned stock market futures sharply positive. However, continuing claims rose to 1.875 million, the highest since November 2021. The four-week average of claims also increased to 240,750, the highest in nearly a year. Concerns persist due to a modest nonfarm payroll increase and a rising unemployment rate, prompting market speculation that the Federal Reserve might cut interest rates soon. This reaction shows some optimism, countering fears from the jobs report. In Utah, weekly jobless claims rose to 1,348 from the previous week's 936, an increase of 412 claims, which is a significant rise of approximately 44%. While the overall job market in the U.S. showed signs of slowing, Utah's job growth percentage increase has been significant.

Consumer Price Index - The next CPI report, set for release on August 14, will not be covered in this publication. Based on the Federal Reserve's July meeting, we anticipate that the upcoming CPI data may show continued easing of inflation. If the next CPI report confirms this trend, it would increase the likelihood of a rate cut as early as September. Last month's CPI report showed a 0.1% decline in US consumer prices, the first monthly drop since May 2020, bringing annual inflation down to 3% and raising hopes for a Federal Reserve rate cut.

Fed Meeting - The Federal Reserve kept short-term interest rates unchanged during its July 30-31 meeting but noted progress towards its 2% inflation target, hinting at potential future rate cuts if supported by economic data. Despite no immediate indication of a rate reduction, the Fed acknowledged improving economic conditions and the need for further progress. Chair Jerome Powell hinted that a rate cut could happen as early as September if inflation continues to ease. The Fed's statement marked an upgrade in language, reflecting better balance in achieving employment and inflation goals. Recent data shows inflation easing and GDP growth at 2.8%, though labor market strength is slightly waning.

Utah Real Estate Market

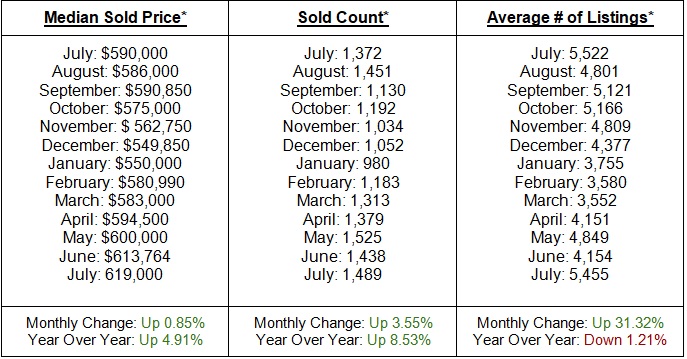

In July, the median sold price increased by 0.85% month over month and 4.91% year over year, reflecting strong buyer demand and confidence in the market. The number of sold properties rose by 3.55% month over month, indicating positive market activity despite potential economic uncertainties. However, the average number of listings saw a substantial month over month increase of 31.32%, which will require additional demand to offset this surge in available inventory. Overall, the market showed consistent growth and strong demand, but the significant jump in listings highlights the need for sustained buyer interest to maintain this momentum.

Rent Report

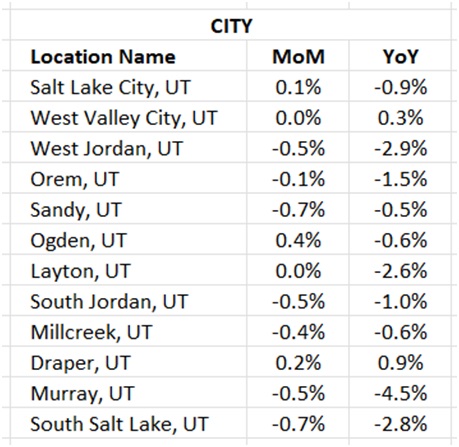

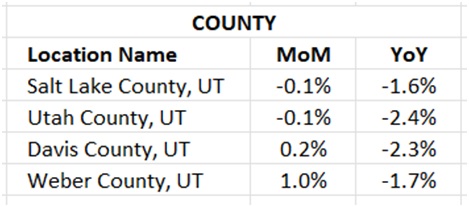

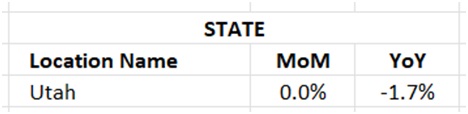

In July, the rental market across Utah displayed varied trends. Salt Lake City experienced a slight month-over-month increase in rental rates, reporting a 0.1% rise. Ogden saw a notable month-over-month increase of 0.4%. Conversely, cities like West Jordan and South Salt Lake saw declines together with other cities. At the county level, Weber County reported a significant month-over-month increase of 1.0%. Overall, Utah’s statewide rental rates remained flat month-over-month, with no change, but continued to show a year-over-year decline of 1.7%, highlighting an ongoing trend of annual decreases in rental rates across the state.

|  |

|

Industry Updates

President Biden's Housing Cost Proposal - President Joe Biden announced proposals to reduce housing costs, including withdrawing tax credits from landlords who raise rents by more than 5% annually over the next two years. This applies to landlords with over 50 units, covering more than 20 million rental units. Exceptions are made for new construction and major renovations. Additional efforts include using surplus federal land for affordable housing and providing $325 million in grants to seven cities for housing projects. Despite opposition from housing groups, Biden's administration argues that the rent cap is a temporary measure to control rent hikes until more rental units become available but we remain skeptical of any solutions that limit a landlord’s ability to charge a fair market rent.

Build-for-Rent Trend - According to Apartment List, single-family homes constitute two-thirds of the US housing stock, with 16.6% now being rented due to strong demand and a lack of affordable homeownership opportunities. Rising home prices and high interest rates have made renting the only viable option for many. The "built-for-rent" (BFR) model, involving large-scale developments designed for rental from the start, is booming, with 85,000 BFR homes starting in 2023 alone. Single-family rentals, which offer more space and cater to larger households, now account for over 40% of all renters. However, while single-family rentals provide flexibility and access to suburban living, the involvement of institutional investors raises concerns about affordability and homeownership access. The financial gap between renting and owning remains significant, and this trend is expected to draw increased scrutiny from policymakers.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai