As a snowy March gives way to warmer April temperatures, our focus has rapidly changed from snow removal and frozen pipes to de-winterizing sprinkler systems and servicing AC units and swamp coolers. Never a dull moment in the rental management business. In this month’s update, we will discuss cooling inflation data, warmer temperatures causing potential flooding, and highlight the impacts of rent control measures (like the ones we fortunately avoided during the most recent legislative session). But first, headlines.

Headlines

March Jobs Report - The March 2023 jobs report showed that the US economy added 236,000 jobs, slightly below expectations of 238,000 and well below the 326,000 added in February. The total number of jobs added in March was also the lowest total since December 2020. Additionally, the unemployment rate ticked down to 3.5% against expectations of it holding steady at 3.6%. These numbers suggest that the labor market is still healthy amid the Fed’s battle against inflation, but that the pace of job growth is slowing.

Weekly Jobless Claims - New jobless claims came in at 239,000 for the week ending April 8th. This marks a jump of 11,000 claims above the previous week’s figures and exceeded analyst expectations of 232,000 claims. This steep rise in claims, along with a cooling March jobs report, is exactly the sign of weakness in the employment market the Fed has been desperate to see since plotting a course of aggressive interest rate increases. Locally, Utah had 1,938 new filers, which marks a 28% increase from the prior week so these figures will be worth monitoring as we keep an eye towards increasing delinquencies. The Fed is not meeting this month, so hopefully this trend continues into May and further rate increases are put on hold.

March Consumer Price Index - According to the most recent CPI report, inflation has fallen to the lowest level since May of 2021. Consumer prices rose 5% for the 12 month period ending in March, marking the ninth consecutive month of falling inflation. We aren’t out of the woods yet, however, as core CPI or the index minus the volatile food and energy components, grew 0.4% for the month resulting in a 5.6% annual growth rate. By comparison, February’s numbers were 0.5% month over month and 5.5% annually. While these numbers are far better than we saw last year, the pace of any cooling is slowing and inflation remains well above the Fed’s target of 2%. This could result in additional rate hikes if inflationary pressures remain stubbornly present.

March Fed Meeting - The Federal Open Market Committee (FOMC) met on March 21-23 and decided to raise the target range for the federal funds rate by 0.25 percentage points to 4.75% to 5.00%. The Fed also indicated that it expects to continue to raise rates at a gradual pace over the coming months. The decision to raise rates was made in light of strong economic growth and rising inflation, and if the past year is any indication, they remain committed to keeping inflation in check. The Fed only schedules meetings to set rates eight times each year, so their next meeting isn’t until May 3rd.

How Do Landlords Respond to Rent Control Policies

Rent control as a policy has both its proponents and critics, with passionate stakeholders on each side of the issue. Ideologically, neither side is likely to change their view, but a recent survey from the NAA sheds some light on how the implementation of rent control policies impacts landlord decision making and that is interesting regardless your stance on the issue. The survey, which was conducted between December 2022 and February 2023, polled 24 housing providers ranging from large 1,000+ unit companies to small mom and pop landlords in the rent controlled markets of St. Paul MN, Santa Barbara CA, and Portland OR.

Before we highlight the results, it’s probably best to summarize the case for and against rent control to provide some context. Proponents of rent control argue that it promotes affordability, stability, economic diversity, housing supply preservation, and tenant protection. By maintaining affordable housing for low- and middle-income families, rent control can prevent rapid rent increases, foster stability in communities, and reduce displacement. This helps maintain economically diverse neighborhoods and preserves existing affordable housing stock by discouraging landlords from converting rental units to more lucrative uses like condominiums or short term vacation style rentals. Additionally, rent control policies often include provisions that protect tenants from unfair evictions and ensure habitable living conditions. Reasonable people wouldn’t argue that any of these goals are misplaced, but opponents would likely point to the unintended consequences of rent control as a policy.

These critics of rent control policy argue that it may lead to reduced investment in housing, misallocation of resources, lower quality housing, and the inequitable distribution of benefits. Rent control can limit the financial incentive for developers to build new rental housing or maintain existing units, potentially leading to a decrease in housing supply and exacerbating housing shortages. It may also result in inefficient allocation of housing resources, as tenants with rent-controlled units have little incentive to move, even if their housing needs change. Furthermore, rent control can discourage landlords from investing in the maintenance and improvement of their properties, leading to a deterioration of housing quality over time. Critics also point to the potential for inequitable distribution of benefits, as rent control may disproportionately benefit higher-income tenants who secure rent-controlled units while leaving lower-income tenants competing for a limited supply of non-rent-controlled housing.

The findings from the survey suggest that some of these potential downsides are in the forefront of investors minds, at least in those markets. The key findings were:

- 71% of housing providers say rent control impacts their investment and development plans with the actions being taken including reducing investments, shifting plans to other markets, and canceling plans altogether.

- 54% of housing providers said they expect or would consider selling some assets due to the financial strains of rent control including the absorption of essential maintenance costs.

- 61% of housing providers have or anticipate the need to defer work on rent-regulated properties.

- 58% of housing providers are aware of a higher-income resident occupying a rent-controlled apartment.

This study, like all others, is only so useful in drawing conclusions. The sample size is small with only two dozen respondents and the potential for bias exists when you consider the source, but like it or not, these are insights into how landlords both understand the issue and are planning to respond. The takeaway here is that the overall effectiveness of rent control depends on its design and implementation. While it can offer certain benefits, such as promoting affordability and stability, it can also have negative consequences, such as reducing investment in housing and increasing deferred maintenance. Policymakers must carefully weigh these benefits and drawbacks and consider alternative policies, such as housing vouchers or increased investment in affordable housing development, in order to address housing affordability issues in the most effective manner possible while minimizing unintended consequences.

Utah Real Estate Market

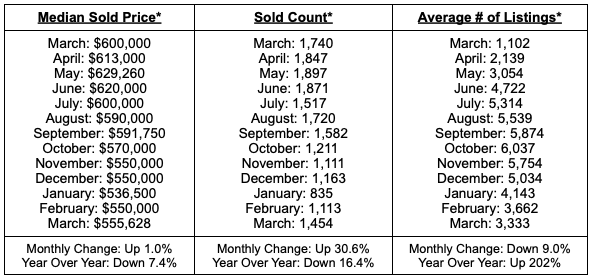

The sales figures for March 2023 were all good news. The median sold price of a single family home in Salt Lake, Utah, and Davis counties climbed by 1.0% from the previous month, we saw a 30.6% increase in completed transactions, and a 9% decline in the average number of active listings. This reversal would be expected as we enter the spring selling season on a 5 week streak of falling mortgage rates. As always, context is important. If we compare this data with this time last year, prices are more than 7% lower, we are seeing 16.4% less completed transactions, and inventory levels are over 200% higher. Let’s hope the recent upward momentum can continue.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Utah Rent Report

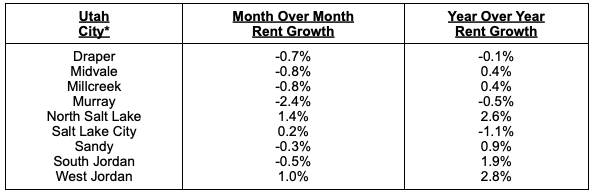

Locally, Utah rents continue to cool across the valley with the exception of the North Salt Lake, Salt Lake City, and West Jordan submarkets which showed month-over-month rent growth. As rents continue to fall, three of the submarkets we track have given up all of their annual gains with the other six struggling to remain in positive territory. It wouldn’t be a surprise however to see this balance out as we enter the summer leasing season.

*Rental data provided by apartment list.

Industry Updates

Appeals Court Overturns Ban on Asking About Criminal History - A recent court ruling has determined that landlords are allowed to inquire about a tenant's criminal history. The decision, which overturns a previous Department of Housing and Urban Development (HUD) guideline, states that landlords can legally ask prospective tenants about their criminal records during the application process. The court ruled that HUD failed to provide sufficient evidence to prove that such inquiries disproportionately impact minority applicants, and therefore, the practice is not in violation of the Fair Housing Act. The ruling is a victory for landlords and could have implications for other cities with similar ordinances.

Banking Failures Impact Rental Housing - The recent failures of community banks including Silicon Valley Bank and Signature Bank, have negatively impacted the rental housing market. These banks were previously key sources of financing for rental property development and SVB had contributed roughly $1.1 billion in investments and $1.6 billion in loans for nearly 10,000 affordable housing units in the Bay Area alone. These banking failures have made it more difficult for landlords and property managers to secure financing for new projects which could lead to a decline in the construction of affordable rental housing units.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai