This July, there’s no shortage of things happening in the real estate world and we’re here to help you make sense of it all. The job market remains steady, inflation is cooling, and a newly passed federal tax bill is set to impact both investors and operators in meaningful ways. We’ll take a closer look at how the rental market has evolved through the second quarter and share insights to help you stay ahead of the curve. Let’s dive in!

Headlines

June Jobs Report - The U.S. economy added 147,000 nonfarm payroll jobs in June, surpassing expectations of 110,000 and showing continued labor market resilience. Despite the headline gains, the labor force participation rate dropped to 62.3% as more people exited the workforce, and the unemployment rate unexpectedly fell to 4.1%. Wage growth remained moderate suggesting limited inflation pressure. These figures led markets to largely dismiss the possibility of a July interest rate cut, pushing expectations for the next rate move to September.

Weekly Jobless Claims - U.S. weekly jobless claims unexpectedly fell to a seven‑week low of 227,000 during the week ending July 5, dropping 5,000 from the prior week and defying economists’ forecasts, which suggested 235,000. This decline underscores a broader trend of subdued layoffs and tepid hiring, leaving the labor market stable but challenging for job seekers, evidenced by a rise in the average duration of unemployment to 10.1 weeks . Added uncertainties like tariffs continue to weigh on hiring decisions. On a local level, Utah saw its initial claims increase modestly to 1,343 from 1,240 during the same period, an uptick of 103 claims which aligns with the national picture: minor volatility but no sign of mass layoffs. This suggests a labor market holding firm overall, though pockets of regional fluctuation likely due to seasonal shifts are emerging.

Consumer Price Index - The next Consumer Price Index (CPI) report will be released on July 15, 2025, and falls outside the scope of this publication but rest assured, we’ll cover it in our next update. For now, here’s a quick recap: In May, inflation rose just 0.1%, bringing the annual rate to 2.4%, while core inflation also came in soft at 0.1% monthly and 2.8% annually, both below expectations. This eased market concerns and renewed calls for rate cuts. Fed’s decision to hold rates steady while signaling two possible cuts later this year, has tempered hopes for an immediate shift in policy.

Fed Meeting - The Federal Reserve kept interest rates steady at 4.25%-4.5% in June but signaled two possible cuts later in 2025 despite persistent inflation and slowing economic growth. Projections show lower GDP and higher inflation, with officials divided on the timing of future cuts. While labor market and consumer data hint at a cooling economy, Fed Chair Jerome Powell emphasized a wait-and-see approach. President Trump continues to pressure the Fed to slash rates, citing high government debt costs, but concerns over tariffs, global conflicts, and inflation are keeping policymakers cautious.

Adapting to the New Normal: Rental Market Insights for Q2 2025

As we step into the second quarter of 2025, the rental housing market is undergoing a noticeable shift. While some metrics suggest a softening environment, the reality is far from a downturn. Instead, we are seeing a rebalancing, a return to pre-pandemic market norms following years of exceptional tightness.

For property owners, this means the market is no longer as forgiving. Margins are under pressure, leasing timelines are longer, and today’s renters are more selective. In this environment, profitability depends not on raising rents alone, but on minimizing vacancy, aligning with renter expectations, and working closely with your property manager to keep your asset performing at a high level.

It’s Becoming a Tenant’s Market

The signs are clear. First, time on market has increased significantly, nearly doubling compared to 2022. In Q1 2025, properties sat vacant for an average of 41 days, with the median at 32 days, meaning it’s now taking longer than usual to fill units across all property types. Second, lead volume per rental listing has declined. In 2021–2022, listings often generated 30+ inquiries; today, that number has fallen below 22. With fewer leads per listing, converting qualified prospects efficiently is critical to reducing downtime.

Third, concessions are on the rise, particularly around pet policies. Year over year, there has been a 5.6% increase in rental listings that allow pets indicating that landlords are becoming more flexible to meet shifting tenant expectations.

Rents Are Still Climbing—But Don’t Let That Fool You

Despite a more competitive leasing environment, rental prices continue to rise across many U.S. markets. This price growth isn’t accidental, it’s being driven by two long-standing forces: limited housing supply and persistent inflation. The number of rental units priced under $1,000 continues to shrink, while higher-priced units those listed above $1,500 are being leased faster, suggesting that higher-income renters remain active and competitive. In fact, April 2025 marked the highest median rent on record nationwide.

But Utah tells a different story.

According to a recent report by the Kem C. Gardner Policy Institute, multifamily construction in Salt Lake County and surrounding areas has surged over the past 18 months, introducing thousands of new units to the market. This added inventory particularly in Class A and B properties has led to downward pressure on rents and an uptick in vacancy rates, especially in urban centers.

This increase in supply has started to put downward pressure on rents and driven up vacancy rates, especially in urban centers. By early 2025, multiple reports show that rents across the Wasatch Front have either flattened or declined. To stay competitive, many landlords are offering larger incentives—such as free rent, reduced security deposits, and more flexible pet policies.

For property owners, this means rent growth alone is no longer a reliable driver of returns especially in overbuilt or highly competitive areas. To maintain strong performance, it’s essential to focus on strategies that limit vacancy days, improve tenant retention, and align with what today’s renters are looking for.

Price It Right from Day One: Why It Matters More Than Ever

In today’s slower rental market, one of the smartest moves you can make as a property owner is to get the pricing right from the start. Even a slight overprice can lead to extended vacancy periods—costing you hundreds, if not thousands, in lost income. In Q2 2025, we’ve seen that units priced just 5% above market average often sit unleased for 2–4 weeks longer than competitively priced homes.

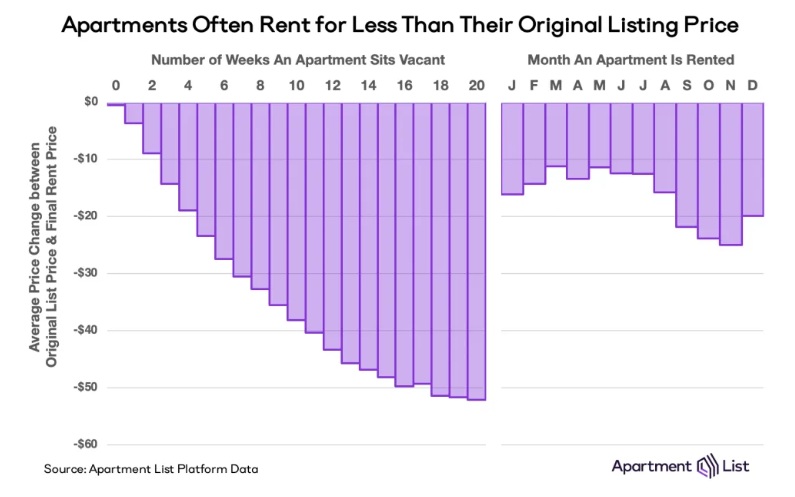

In fact, data from Apartment List shows that properties sitting on the market for more than 8 weeks lose over $40 in average monthly rent, with losses peaking in fall and early winter. This clearly illustrates how delayed leasing due to overpricing results in real financial loss and why smart, market-driven pricing from day one is essential to protecting your returns.

That’s why many successful owners are leaning into data, looking at real-time comps, local reductions, and seasonal trends to guide rental pricing. This proactive strategy doesn’t just protect against loss, it gives you a leasing advantage without needing to offer steep concessions. With longer lease-up times becoming the norm, accurate pricing isn’t just good practice, it’s essential to protecting your returns.

Utah Real Estate Market

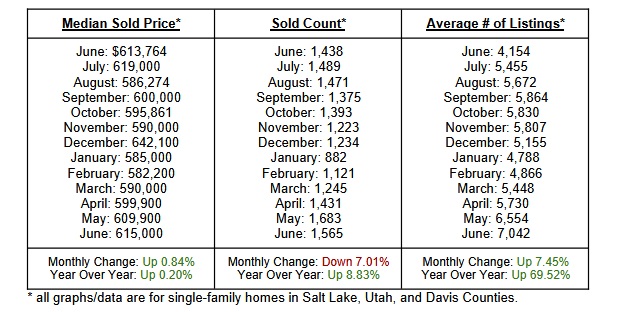

The Utah real estate market remained resilient in June, continuing to show steady growth even as buyer activity cooled slightly from May’s surge. The median sold price edged up to $615,000, marking a 0.84% month-over-month increase and continuing the gradual upward trend in home values. While the number of homes sold dipped slightly from May, sales volume still reflects strong year-over-year growth. Most notably, inventory surged 7.45% from the previous month and nearly 70% compared to last year, giving buyers more options and signaling a more balanced, competitive market

Rent Report

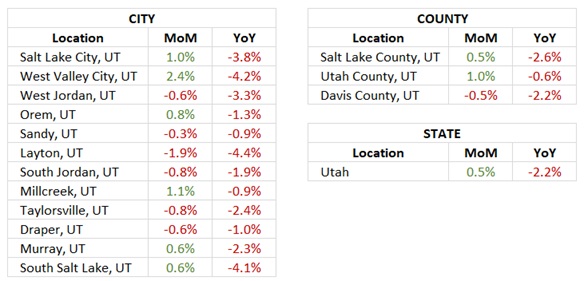

Utah’s rental market remained relatively stable in June, with slight month-over-month gains across most areas, though year-over-year declines continue to weigh on long-term growth. West Valley City led all tracked cities with a 2.4% increase, followed by Millcreek (1.1%) and Salt Lake City (1.0%). Meanwhile, cities like Layton (-1.9%) and South Jordan (-0.8%) posted sharper declines. At the county level, Utah County saw the strongest monthly rise, while Davis County slipped 0.5%. Statewide, rent prices inched up 0.5% compared to May, signaling slow movement in a still-correcting market.

*Rental data provided by apartment list.

Industry Updates

Final Tax Bill Passes - On July 4, 2025, President Trump signed the One Big Beautiful Bill Act (OBBBA) into law, marking a win for the rental housing industry. The legislation, narrowly passed by Congress, includes several housing-friendly tax provisions: it makes the 199A deduction for pass-through entities permanent, enhances the Low-Income Housing Tax Credit (LIHTC), and expands Opportunity Zones. Notably, it avoids controversial changes such as altering capital gains on carried interest or increasing individual tax rates. These outcomes reflect months of coordinated advocacy by the National Apartment Association and industry professionals, who successfully pushed for tax policies that support housing affordability, increase supply, and strengthen the long-term viability of rental housing.

US housing market sees surge in broken deals - The U.S. housing market is experiencing a rise in canceled home purchase agreements, with about 6% of pending contracts falling through in May 2025—up from 5% a year ago. Redfin reports an even higher cancellation rate of 14.6%, the highest for May since 2017. These broken deals are being driven by affordability challenges, high mortgage rates, job instability, poor appraisals, and economic uncertainty. Although pending home sales saw a modest monthly increase in May, overall market activity remains sluggish, with sales of existing homes at their slowest pace since 2009. As a result, Fannie Mae has lowered its 2025 forecast for existing home sales but expects a stronger recovery in 2026 as mortgage rates gradually decline.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai