Spring is in full swing, and for rental operators, that means it's time to gear up for the busy leasing season ahead. In this month's update, we’ll provide insight into the local real estate and rental markets and tell you about an exciting change to your vacancy reporting. Additionally, we will check in on legislation that could speed up future evictions. Let’s start with the headlines.

Headlines

April Jobs Report - In April, the U.S. economy added 175,000 jobs, falling well short of the expected 240,000, while the unemployment rate rose to 3.9%, which was also higher than the anticipated 3.8%. This development raised speculation that the Federal Reserve might consider cutting interest rates in the upcoming months. Sectors like health care, social assistance, transportation, and retail saw significant job increases. Average hourly earnings rose slightly, but at a slower pace than anticipated, which could alleviate concerns about inflation. This indicates a softer labor market and wage growth and led traders to anticipate two interest rate cuts by the end of 2024, with the first expected in September. Despite inflation still being above the Fed's target, this recent employment data suggests rate cuts may again be on the Fed’s radar assuming next week’s CPI report doesn’t cause them to change course.

Weekly Jobless Claims - Weekly jobless claims rose to 231,000 for the week ending May 4, marking the highest level since August 2023. This increase of 22,000 from the previous week is noteworthy with a generally strong labor market. Continuing claims also rose to 1.78 million. While job openings have been declining, hiring reports have been mostly positive, though April's numbers were below expectations. The four-week moving average of claims increased to 215,000, signaling potential economic deterioration. Despite this, markets showed minimal reaction, with stock futures slightly negative. Economists anticipate more volatility in jobless claims as the labor market normalizes. The Federal Reserve is closely monitoring job numbers as they aim to address inflation concerns, with expectations of interest rate adjustments in September.

Consumer Price Index - On May 15th, the Consumer Price Index (CPI) report will be updated. Last month, the CPI rose by 0.4%, surpassing expectations. This marked the third consecutive month of increasing CPI readings, reflecting accelerated job growth. Over the past 12 months, we’ve seen prices increase by 3.5%, the most significant gain since September. Core CPI, excluding food and energy also rose by 0.4%, indicating broad-based inflationary pressures. This led the financial markets to adjust rate cut expectations, but this may change depending on how next week's CPI compares with last week's Job’s report.

Fed Meeting - The Federal Reserve has decided to maintain current interest rates amid persistent inflation concerns. Fed Chair Jerome Powell emphasized that although inflation has slowed, there's a lack of further progress, delaying the possibility of rate cuts. The Fed plans to gradually reduce its balance sheet to ease its grip on the economy. Powell indicated that another rate hike is unlikely, emphasizing the need for convincing evidence before considering rate cuts. The timing of rate cuts remains uncertain, contingent on various economic scenarios, including inflation trends and labor market conditions. Economists expect inflation and economic growth to moderate in the second half of the year, but the timing of the first rate cut is pushed back. Analysts are predicting potential rate cuts starting anywhere from July to December, with November being Wall Street's favored timing. Powell awaits data showing declining rents impacting inflation measures, while reiterating that the economy is not in stagflation.

H.R. 802, the Respect State Housing Laws Act

The U.S. House of Representatives’ Committee on Financial Services voted along party lines to pass the “Respect State Housing Laws Act” (H.R.802), which would eliminate the 30-day eviction notice requirement established in the bipartisan “Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020.” The CARES Act provision mandates landlords give tenants facing eviction for nonpayment of rent at least 30 days' notice before removal. This additional time aims to help tenants address issues or find alternative housing to avoid homelessness. The “Respect State Housing Laws Act” would remove this protection, raising concerns about increased homelessness and housing instability. Committee Ranking Member Maxine Waters highlighted the importance of the notice in reducing eviction rates, emphasizing its impact on families and individuals. The bill passed out of committee along party lines, prompting continued monitoring by the National Low Income Housing Coalition (NLIHC).

Impact of HR 802 on Rental Property Owners

HR 802 will decentralize eviction laws to the states, potentially affecting rental property owners nationwide. While the CARES Act mandates a 30-day eviction notice period, many states like Utah have shorter waiting periods. This prolonged wait can financially impact property owners, despite eviction being a last resort. Supporters, including the National Apartment Association and others, argue that passing the bill would reduce federal bureaucracy in private tenancy matters. Additionally, HR 802 contends that federal eviction policies create confusion for landlords, tenants, and states alike.

Impact of HR 802 on Renters

Now that HR 802, also known as the Respect State Housing Laws Act, has passed, renters across the United States are facing significant changes. Proponents of the law argue that it will lead to lower costs and faster dispute resolutions, while opponents express concerns about potential chaos in the housing industry due to the revocation of CARES Act provisions. The passage of HR 802 has ignited passionate debate about its impact on state housing laws, rental standards, and eviction rates. However, it is important to remember that none of this is new and eviction laws are simply returning to what they were pre-pandemic.

Utah Real Estate Market

In April, the Utah real estate market continued its upward trajectory, with a median sold price of $594,500, marking a monthly increase of 1.97%. The sold count also saw a rise, reaching 1,379 transactions, indicating that buyer demand has returned this spring. The average number of active listings climbed to 4,151, showcasing a steady influx of new properties on the market. Year over year, the market exhibited significant growth, with median sold prices up by 4.71% and the sold count showing an impressive increase of 5.43%. These figures suggest continued strength and resilience in Utah's real estate sector, underscoring sustained buyer interest despite 5 straight weeks of climbing interest rates.

Median Sold Price* | Sold Count* | Average # of Listings* |

April: $567,750 May: $585,000 June: $590,000 July: $590,000 August: $586,000 September: $590,850 October: $575,000 November: $ 562,750 December: $549,850 January: $550,000 February: $580,990 March: $583,000 April: $594,500 | April: 1,308 May: 1,518 July: 1,372 August: 1,451 September: 1,130 October: 1,192 November: 1,034 December: 1,052 January: 980 February: 1,183 March: 1,313 April: 1,379 | April: 3,350 May: 3,480 July: 5,522 August: 4,801 September: 5,121 October: 5,166 November: 4,809 December: 4,377 January: 3,755 February: 3,580 March: 3,552 April: 4,151 |

Monthly Change: Up 1.97% | Monthly Change: Up 5.03% Year Over Year: Up 5.43% | Monthly Change:Up 16.86% Year Over Year: Up 23.91% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

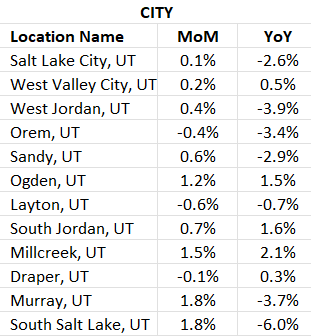

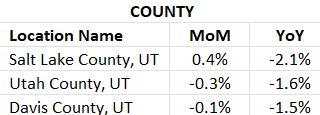

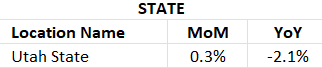

In April, rent prices in Utah were split with some submarkets seeing slight increases and others decreases. Orem and Layton experienced declines for the month, while Murray and South Salt Lake had significant increases from the previous month. However, 7 out of 12 cities still showed year-on-year decreases in rental rates. On the county level, Utah and Davis Counties saw a slight decrease while Salt Lake County had a modest increase and all were still 1-2% down year over year.

*Rental data provided by apartment list.

Industry Updates

HUD's New Income Eligibility Restrictions - The U.S. Department of Housing and Urban Development (HUD) implemented a new standard on April 1, 2024, altering how income limits are calculated for eligibility in Section 8 and other federally assisted housing programs. The new absolute cap of 10 percent reduces eligibility for government housing support, impacting low-income renters and families. Additionally, the change affects low-income housing tax credit (LIHTC) properties by potentially deepening rent restrictions, as rent increases are tied to HUD’s income limits. Previously, HUD applied a year-over-year cap on income limit changes, but now increases are capped at 10 percent. This decision has immediate repercussions, with low-income households facing potential loss of eligibility despite rising living costs. LIHTC properties may struggle with rental income no longer aligning with market fluctuations, jeopardizing project feasibility and existing property viability. Such actions could lead to a reduction in available homes, exacerbating housing affordability challenges. The National Apartment Association (NAA) is advocating against these changes, urging HUD to reconsider and highlighting the potential unintended consequences for the rental housing industry. They continue to engage in federal advocacy efforts to represent the industry's perspective in policy discussions.

Proposal for Rent Increases on Vacant Rent-Stabilized Apartments - The ongoing budget negotiations in New York have brought housing policies under scrutiny, particularly concerning rent-stabilized apartments. Real estate interests are advocating for the reinstatement of rent increases to cover renovation costs, which were restricted by the 2019 Housing Stability and Tenant Protection Act. Assembly Speaker Carl Heastie confirmed discussions around this issue, emphasizing the need to address vacant apartments that landlords hesitate to renovate due to cost concerns. Proposed legislation includes the Local Regulated Housing Restoration Adjustment bill, aiming to allow rent increases on vacated rent-stabilized units, albeit within regulated limits. Landlord groups argue that these measures are necessary to incentivize repairs and maintain affordable housing stock. However, tenant advocates oppose any rollbacks to the 2019 rent laws, expressing concerns about affordability and tenant protections. The negotiations also involve discussions on new tenant protections for non-stabilized apartments and potential tax incentives for affordable housing developers.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai