A quick glance at the weather forecast indicates we might finally be finished with the annual tradition we call “false spring” here in Utah. In addition to warmer temperatures, the real estate and rental markets are also heating up. In this month’s update, we recap the latest trends in housing prices and inflation, take a closer look at how Utah’s rental market is evolving, and explore the growing impact of newly imposed tariffs. But first, this month’s headlines.

Headlines

April Jobs Report - The U.S. economy added 177,000 jobs in April 2025, beating expectations despite ongoing tariff concerns. Unemployment held steady at 4.2%, while wage growth slowed to 3.8% annually—its lowest since mid-2024. Key gains were seen in healthcare, logistics, and finance, although government and manufacturing jobs declined. The better than expected report served to delay expectations of a Fed rate cut until July. Though the full impact of recent tariffs hasn’t surfaced yet, economists say the current resilience offers hope the U.S. may sidestep a recession if trade tensions ease soon.

Weekly Jobless Claims - U.S. unemployment claims dropped to 228,000 for the week ending May 3, better than expected and signaling continued labor market strength. The decline reversed a spring break-related spike, but economists caution that President Trump’s steep new tariffs—especially on Chinese imports—are raising inflation risks and weakening business confidence. While most employers remain reluctant to lay off workers, some trade-sensitive sectors have begun small-scale job cuts. The Federal Reserve held interest rates steady, warning that sustained tariffs could lead to slower growth, higher inflation, and rising unemployment. In Utah, new jobless claims fell to 1,542, down 163 from the previous week, showing continued stability in the state’s labor market.

Consumer Price Index - U.S. inflation cooled more than expected in March, offering a welcome sign of easing price pressures. The Consumer Price Index (CPI) dropped 0.1%, bringing the annual inflation rate down to 2.4% from 2.8% in February. Core inflation—which excludes food and energy—rose just 0.1% month-over-month and hit 2.8% annually, the lowest since March 2021. Falling gasoline prices led the decline, while food costs ticked up slightly and shelter costs rose by just 0.2%. The data offered some relief amid ongoing economic uncertainty, particularly around President Trump’s shifting tariff policies but extreme uncertainty remains. With the next CPI report scheduled for May 13, 2025, all eyes will be on whether this disinflation trend will continue or if the tariff impacts will begin to be felt —and how it may influence future Fed rate decisions.

Fed Meeting - On May 7, 2025, the Federal Reserve held interest rates steady at 4.25%–4.5%, citing rising uncertainty and growing risks of both inflation and unemployment amid the Trump administration’s evolving tariff policies. While inflation has eased slightly, concerns remain that tariffs could trigger a stagflationary scenario—where inflation rises while economic growth slows. Fed Chair Jerome Powell emphasized patience, stating the economy remains solid for now, though recent GDP data showed a slight contraction in Q1. The Fed acknowledged market volatility and trade-related disruptions, particularly from the 10% across-the-board tariffs announced in April. As negotiations with trading partners continue during a 90-day review period, the central bank is holding off on rate cuts, with the next potential adjustment expected in July depending on economic conditions and trade outcomes.

The Impact of Tariffs on Rental Markets

In a dramatic return to “America First” trade policy, President Trump reimposed sweeping tariffs in April 2025, aimed at protecting U.S. workers and correcting global trade imbalances. New tariffs imposed on various goods are expected to significantly alter the economic landscape of the United States in the months to come. While the immediate impact of these tariffs largely affects importers and manufacturers, the long-term implications for the rental market could be severe with their impact reshaping how properties are built, maintained, priced, and lived in.

Understanding Tariffs and Their Ripple Effect

Tariffs are government-imposed taxes on imported goods, designed to encourage domestic production by making foreign products less price-competitive. While they may offer short-term support to local industries, tariffs often result in higher prices for consumers and disruptions across global supply chains. As the cost of goods rises—particularly materials used in construction and maintenance—businesses face increased operational expenses. These added costs can quickly ripple through the economy, ultimately contributing to higher prices in sectors like housing, property management, and development.

Inflationary Pressures

Tariffs increase the cost of construction materials, appliances, and imported goods—expenses that inevitably make their way into the rental market. Property owners, facing higher costs for repairs, renovations, and daily operations, will often look to raise rents to preserve margins. This chain reaction adds to broader inflation in the housing sector, disproportionately affecting low- and middle-income renters. As affordability declines, demand for subsidized or budget-friendly housing rises—potentially pushing some renters into overcrowded or lower-quality living conditions.

Supply Chain Disruptions

Tariffs often lead to delays and shortages in critical building supplies like lumber, metal, and plumbing fixtures. These disruptions can slow down both routine repairs and large-scale construction, extending unit turnover times. In tight markets, even minor delays can have an outsized impact—limiting available inventory, driving up rent, and making it harder for tenants to find homes. Projects delayed or canceled due to cost concerns only worsen the supply-demand imbalance.

Effects on Investment and Development

Rising costs and policy uncertainty can lead investors and developers to hesitate. Some may delay projects, capital improvement or new investment until the economic climate stabilizes. Moreover, lenders may tighten financing terms if construction costs continue to rise unpredictably. This could restrict access to capital for new developments, especially those focused on workforce or affordable housing, compounding long-term supply shortages.

Changing Market Behavior

As rents rise and affordability wanes, both tenants and landlords will adjust. Renters may choose to stay in place to avoid turnover expenses, downsize, seek roommates, or relocate to more affordable options. Landlords, on the other hand, may become more selective with upgrades, delay non-essential maintenance, or revise leasing strategies to hedge against increasing operating costs. These shifts can influence property values, turnover rates, and the overall competitiveness of rental communities.

What Steps can Landlords Take to Protect Themselves?

1. Plan Renovations with Flexibility and Foresight

Avoid peak-season price hikes and material shortages by scheduling upgrades during off-peak times (fall and early winter).

Prioritize materials that are either made domestically or have more stable global supply chains when possible.

Consider phased renovation plans for multi-unit properties to manage costs and reduce downtime.

Delay non essential capital improvements.

2. Build a Stronger Reserve Budget

Volatility in material and labor costs means landlords should increase contingency reserves for capital expenditures and emergency repairs. A 10–20% buffer in your annual maintenance and renovation budget can provide financial breathing room when unexpected price jumps occur or timelines are extended.

3. Seek occupancy over rent increases

Prioritize lease renewals even if it means concessions. No move out means no turnover expenses, and when construction prices are expected to climb, it makes sense to delay those expenses wherever possible.

Utah Real Estate Market

April continued the upward trend seen over the past few months, with gains across pricing, sales volume, and inventory. The median sold price rose to $599,900, marking a 1.68% increase from March and a 0.91% gain year-over-year, signaling modest appreciation in property values. Sales volume climbed nearly 15% month-over-month, indicating stronger buyer activity as the market enters the busy season. Meanwhile, active listings surged 5.18% from March and are now up 38% compared to last year, giving buyers more options and driving overall market momentum.

Median Sold Price* | Sold Count* | Average # of Listings* |

April: $594,500 May: $600,000 June: $613,764 July: 619,000 August: 586,274 September: 600,000 October: 595,861 November: 590,000 December: 642,100 January: 585,000 February: 582,200 March: 590,000 April: 599,900 | April: 1,379 May: 1,525 June: 1,438 July: 1,489 August: 1,471 September: 1,375 October: 1,393 November: 1,223 December: 1,234 January: 882 February: 1,121 March: 1,245 April: 1,431 | April: 4,151 May: 4,849 June: 4,154 July: 5,455 August: 5,672 September: 5,864 October: 5,830 November: 5,807 December: 5,155 January: 4,788 February: 4,866 March: 5,448 April: 5,730 |

Monthly Change: Up 1.68% Year Over Year: Up 0.91% | Monthly Change: Up 14.94% Year Over Year: Up 3.77% | Monthly Change: Up 5.18% Year Over Year: Up 38.04% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

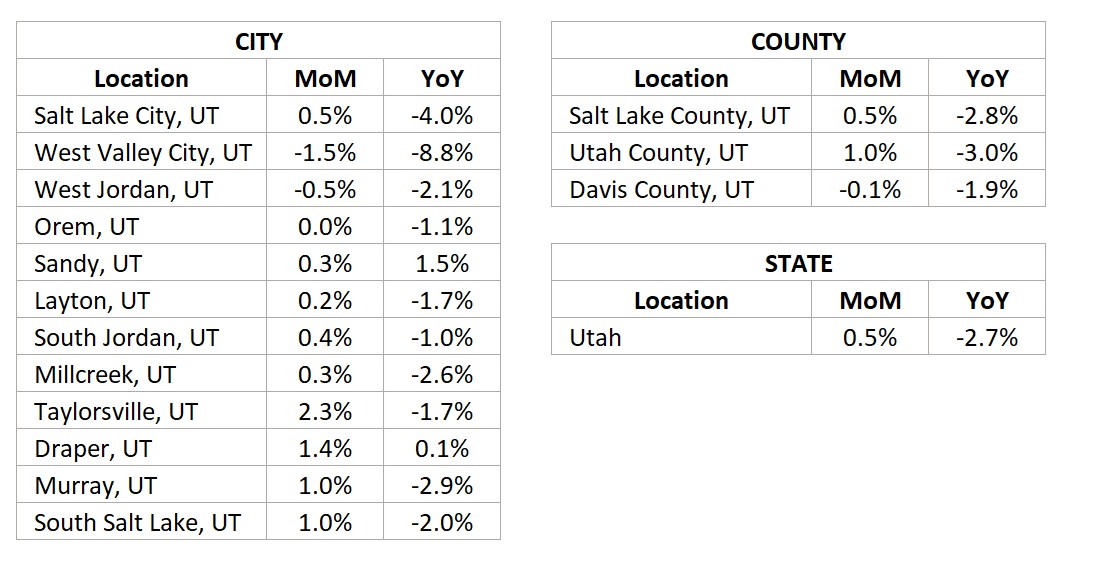

Utah’s rental market continued its path toward stabilization in April, with most cities and counties posting monthly gains, though year-over-year figures remain negative in many areas. Taylorsville, Draper, and Murray led the way in month-over-month growth, while West Valley City posted the largest decline. At the county level, Utah County saw the strongest monthly increase, while Davis County dipped slightly. Statewide, rents rose 0.5% from March, reflecting steady but cautious improvement amid ongoing affordability challenges.

*Rental data provided by apartment list.

Industry Updates

Washington Supreme Court Rules on CARES Act Notice - The Washington Supreme Court ruled that the CARES Act’s 30-day notice to vacate requirement applies only to evictions for nonpayment of rent, not for other lease violations. This decision resolves conflicting interpretations among the state’s appellate courts and reinforces that the Act was intended as temporary emergency relief during the COVID-19 crisis—not a permanent change to eviction laws. While not binding in other states, the ruling may influence similar cases elsewhere. Housing providers should consult legal counsel, as CARES Act enforcement continues to vary by jurisdiction.

Tax Policy Headlines Advocate 2025 - In late March, over 800 rental housing professionals gathered in Washington, D.C., for Advocate 2025—NAA’s annual advocacy event—where they met with lawmakers to push for sustainable housing policies. The main focus was tax reform, with advocates urging Congress to preserve the 20% business income deduction, expand the Low-Income Housing Tax Credit, and protect state and local tax deductions, all to support affordability and supply. They also pushed for the passage of the Respect State Housing Laws Act to clarify that the CARES Act notice requirements ended in 2020. With Republicans now controlling Congress and the White House, attendees emphasized the need to educate lawmakers about the rental housing industry’s realities. Across 260 meetings, they shared how federal policies affect local housing operations and affordability, highlighting that meaningful change starts with awareness and relationship-building at every level.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai