From leaf senescence to cooler temperatures, October has always brought change. This October also brings a government shutdown, climbing inflation, and uncertainty in the employment market. Additionally, while fresh trouble might be brewing for institutional landlords nationally, home prices are up and annual rent growth is getting closer to turning positive here locally. As always, we have a mixed bag. Let’s dive into the headlines.

Headlines

September Jobs Report - With the official jobs report delayed by the government shutdown, economists are relying on private data for insight. While alternative data is not a direct replacement, it does give a glimpse into current labor conditions. ADP reported that U.S. private-sector employers lost about 32,000 jobs in September, with August’s gains revised into slight losses after data adjustments. Taken together with earlier BLS data showing an unemployment rate of 4.3% and the slowest hiring pace in over a decade, these figures suggest the job market is steady but clearly losing momentum as we move into the final quarter of the year.

Weekly Jobless Claims - Jobless claims in the U.S. rose to an estimated 235,000 for the week ending October 4, up from 224,000 the previous week as the ongoing government shutdown likely pushed some federal contractors to file for benefits. Although official economic data collection has been suspended, state reports still show a modest increase in both initial and continuing claims. Economists expect this temporary rise to continue until the government reopens but note that overall claims remain relatively low. In Utah, for example, new unemployment claims actually fell to 1,161 from 1,287, showing that the impact of the shutdown hasn’t hit all states equally. The broader job market remains sluggish, with fewer companies hiring or letting go of workers, and the Fed recently cut interest rates to help stabilize employment amid growing uncertainty.

Consumer Price Index -With the next Consumer Price Index release scheduled for October 15, this publication will miss the most recent inflation data. As we await those figures, here’s a quick recap of last report key developments. In August, U.S. inflation surprised on the upside with headline CPI rising 0.4% month-over-month (2.9% year-over-year) and core CPI up 0.3% (3.1% y/y), while weekly jobless claims jumped to 263,000, marking the highest level since October 2021. These mixed signals came just ahead of the Fed’s September 17 meeting, where the central bank responded by cutting its policy rate by 25 basis points to 4.00 %–4.25 % to address signs of labor-market weakening. Despite inflation remaining above target, the rate cut signaled the Fed’s readiness to shift toward a more supportive monetary stance in response to signs of a weakening job market, reinforcing expectations for additional rate reductions in the coming months.

Fed Meeting - With the next Federal Reserve meeting scheduled for October 28–29, this update will miss the upcoming policy decision, but here’s a look back at September’s action and what may come next. The Fed voted 11–1 to cut its benchmark rate by 25 basis points to 4.00%–4.25%, with Chair Jerome Powell calling it a “risk management” move aimed at balancing slowing job growth and still-elevated inflation. Most policymakers, including Governors Bowman and Waller, supported the decision, while Governor Miran dissented in favor of a deeper cut. Looking ahead, projections and market forecasts suggest the Fed is likely to deliver two more quarter-point cuts before year-end, one in October and another in December as officials seek to cushion a softening labor market without reigniting inflation.

Tenants Launch First-Ever Nationwide Union Effort Against Private Equity Landlord

In an unprecedented campaign, more than 1,000 renters across five states are uniting to form tenant unions across Capital Realty Group’s (CRG) affordable housing portfolio, marking the first coordinated, multi-state effort to collectively bargain with a private equity landlord. The Tenant Union Federation (TUF), led by housing advocate Tara Raghuveer, aims to establish a sector-wide framework for tenant bargaining, similar to how workers negotiate across corporations in industries like fast food and rideshare.

Tenants say they’re fighting to address widespread maintenance issues including leaks, pests, mold, and slow repairs that affect residents across dozens of CRG-owned properties. With over 22,000 units nationwide, CRG is a major player in federally subsidized housing, where rents are capped in exchange for affordability. After early discussions with company representatives stalled, TUF is pushing for a portfolio-wide collective bargaining agreement that would formalize property standards and prevent retaliation against union members.

Why It Matters

This effort could redefine tenant-landlord relations in the U.S. housing sector. If successful, it would be the first large-scale application of collective bargaining to housing, establishing a model where renters negotiate directly with major property owners not just at the building level, but across entire portfolios. The initiative reflects growing backlash against private equity’s role in housing, as large investment firms continue buying affordable properties and driving consolidation in the rental market. Analysts say the campaign could pressure both investors and policymakers to rethink oversight and accountability in subsidized housing.

Industry Implications

A successful agreement could set a national precedent for multi-property unionization, potentially shaping future tenant protection laws and serving as a benchmark for similar efforts across the country. At the same time, CRG’s portfolio-wide organizing campaign is likely to invite increased federal and state scrutiny of how private equity firms manage low-income housing. Policymakers may also consider formalizing tenant bargaining rights or tightening habitability standards in federally backed properties. Beyond policy, the campaign underscores growing reputational and operational risks for investors and landlords who overlook tenant engagement or fail to maintain housing quality.

What’s Next

Tenant leaders plan to expand union organizing in additional CRG markets and pursue recognition under state laws where applicable. Meanwhile, housing advocates are monitoring whether this approach gains traction with tenants of other large landlords potentially creating a national tenant labor movement. With inflation, high rents, and affordability pressures continuing, this campaign could mark the beginning of a new phase in U.S. housing activism - one that treats safe, affordable living conditions as a collective right, not an individual negotiation.

Utah Real Estate Market

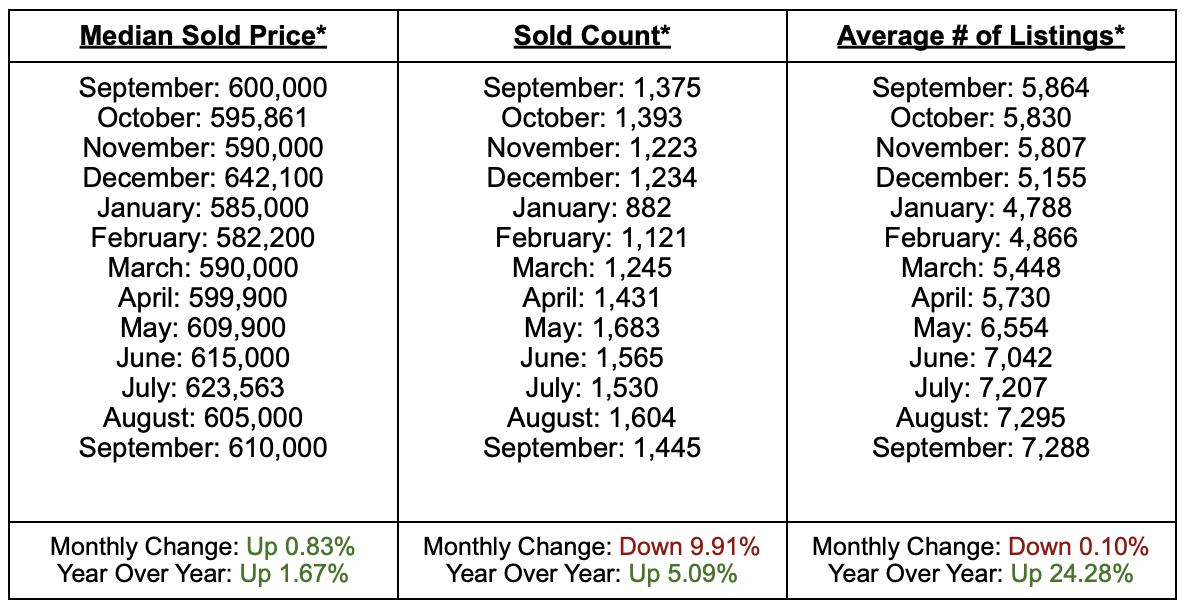

The Utah real estate market showed signs of steady balance in September, with the median sold price rising slightly to $610,000, a 0.83% increase from August and 1.67% higher than last year. Sales activity slowed following last month’s uptick, with 1,445 homes sold, reflecting a 9.91% monthly decline but still up 5.09% year over year. Inventory held nearly flat at 7,288 active listings, maintaining its highest levels of the year and remaining 24.28% above last year’s total. Overall, the market continues to show healthy movement, with prices stabilizing, inventory staying strong, and demand remaining consistent despite seasonal moderation.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

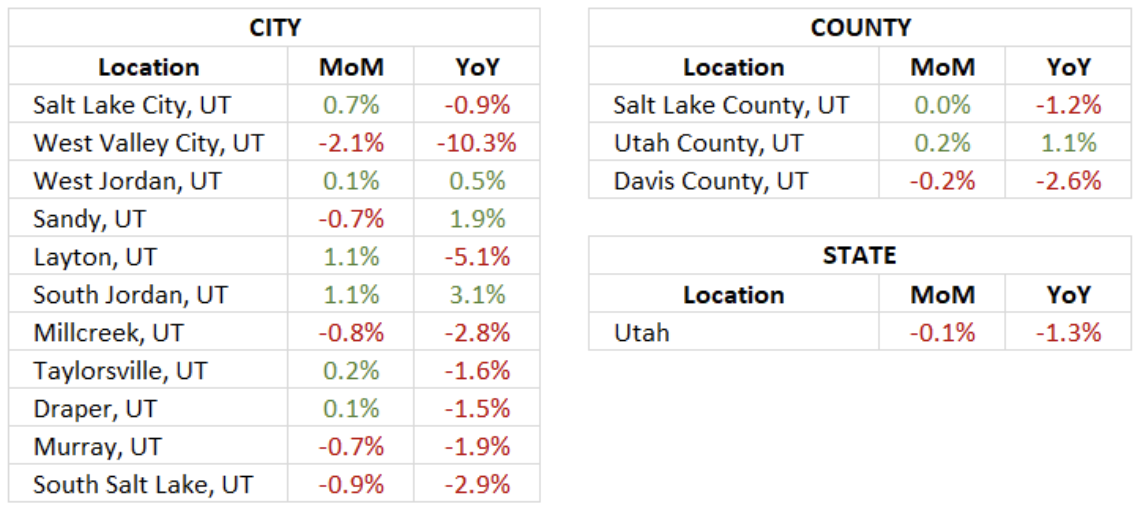

In September, Utah’s rental market remained largely stable, showing only minor fluctuations across most areas. At the state level, prices dipped slightly by 0.1% month over month and 1.3% year over year, reflecting a steady but subdued trend. County data showed mixed results. Utah County posted a modest 0.2% monthly gain, while Davis County saw a 0.2% decline. Among cities, Layton and South Jordan led with 1.1% increases, whereas West Valley City recorded the sharpest monthly drop at -2.1%. Overall, rent prices continue to hover near steady levels, suggesting a market finding balance after months of gradual adjustment.

*Rental data provided by apartment list.

Industry Updates

HUD Leads Way on CARES Act - The U.S. Department of Housing and Urban Development (HUD) has submitted six major rules to the White House for approval, signaling significant shifts in federal housing policy. Two key proposals include eliminating the CARES Act’s 30-day eviction notice requirement for HUD-assisted properties and revising the Disparate Impact Rule to align with President Trump’s executive order emphasizing merit-based housing policies. These moves would roll back Biden-era tenant protections and restore elements of HUD’s 2019 framework, limiting federal oversight in eviction processes and discrimination claims. Additional pending rules could introduce work requirements, immigration status verification, and changes to gender identity protections and housing assistance programs. The National Apartment Association (NAA) supports these actions, viewing them as steps toward reducing federal intervention and restoring state authority, and continues to engage with the administration to influence the final rulemaking process.

Renting is Cheaper Than Buying in Many US Markets - In 2025, renting has become significantly cheaper than buying in much of the U.S., with renters saving an average of $400 per month compared to homeowners. High mortgage rates between 6–7%, record home prices, and stagnant wages have widened the affordability gap, making ownership increasingly out of reach, particularly in major urban areas. Meanwhile, rent growth has cooled. Zillow projects just a 2.7% increase this year versus 4.5% in 2024 offering renters stability amid an affordability crunch. Analysts note that renting provides liquidity, flexibility, and lower maintenance costs, as homeowners face annual upkeep expenses exceeding $8,000. Economic experts attribute this shift to persistent housing shortages and high borrowing costs, which have slowed home sales and intensified rental demand. While buying still supports long-term wealth building for financially stable households, 2025’s housing dynamics increasingly favor renting as the more practical and flexible option, at least until mortgage rates and housing supply find balance.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai